Mortgage

- How to calculate a mortgage Sberbank Currently, mortgage loans are very popular among the population. Of course, this is quite convenient, because buying a house today, pay for it over a long period of time. Undoubtedly, a leader in the provision of mortgages is a savings Bank.

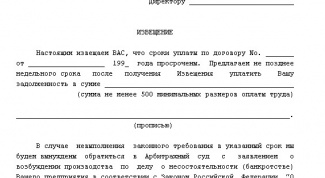

- How to write a letter about the debt There are situations when agreements between individual institutions, individual entrepreneurs or even individuals to pay for the delivered goods or services, violated one of the parties. It can be installed for breakdown time, any transfers or full refusal of payment. In this case, you are to write a letter on each of the debt. This notice serves as a reminder of the debt and contains some mandatory items.

- How to apply for social mortgage in Saratov Social mortgage is sometimes the only opportunity to obtain their own housing for low-income families. Take advantage of this program can citizens who do not have their space or a family member have no more than 14 square meters.

- How to calculate interest on a loan agreement When repayment of funds borrowed by the contract of loan, the question arises: as the interest for the use of funds? The fee for the use of borrowed funds can be directly specified in the contract. If the interest rate is not set, then the borrower shall pay to the creditor interest in accordance with the refinancing rate set by Central Bank at the time of repayment of the loan.

- How to extract money from the debtor It so happens that you took the money borrowed for a certain period, and to give in no hurry. Refer to times of crisis, family problems or lack of earnings. Of course, in life anything can happen, but you gave your money and have every right to get them back. We'll show you how to clear the debt from the debtor.

- How to talk to collectors It is best just not to bring the case before the intervention of the collectors in a timely manner to fulfill obligations for the debts, and even better - they do not climb. But not always and not all succeed. And often the foreign debt collectors can get their calls is not the debtor, and their relatives, and even strangers.

- How to calculate interest under the loan agreement The loan is reimbursable transaction, and the law has provided not only his return, but the recovery percent. The lender is entitled to receive from the borrower of percent on an amount of loan in sizes and in the manner specified in the contract. In the absence of the contract terms of the size of percent their size is determined existing in a residence of the creditor, and if the lender is a legal entity, its location the Bank interest rate (refinancing rate) at date of payment by the borrower of the debt or its corresponding part (article 809 of the Civil code of the Russian Federation).

- How to calculate penalty The result of the late payment may need to calculate penalties. The penalty can be stipulated in legislation or determined by agreement of the parties. Nonobservance of the written form of the agreement on liquidated damages is invalid. In determining the amount of penalties in the agreement need to observe the principle of reasonableness.

- How to return a percentage of the mortgage In accordance with article 220 of the RF Tax Code, the taxpayer has the right to receive property tax deduction in the amount spent on repayment of interest on target loans (credits). Loans should be issued on the territory of the Russian Federation and spent for the construction or purchase of housing in the Russian Federation.

- How to repay the debt without receipts Hardly people are of sound mind and good memory, will take a large sum of money without a receipt unfamiliar face. Giving money to the debt, non-familiar or unfamiliar – and take the receipt. It should be written by the hand of the borrower, and ideally certified by a notary. If you have in debt without a receipt, then surely a close person and good friend. In this case, agree on a refund on good, explaining to the person that you are in a difficult financial situation. In most cases this is enough to return the debt.

- How to return the money on receipt The receipt is sufficient grounds for a refund. She is recognized by court as written evidence of the loan. Certain forms of receipts not exist. The only condition is to write the debt instrument by the hand of a man who borrows. Must also specify the exact details of the borrower.

- How to recover a debt if there are no receipts To recover the debt, issued without receipts, legal means is possible only contacting law enforcement or the court. All other measures to recover the debts are illegal and are punishable by law. No threats, appeals to a collection Agency or to private detectives don't do if you don't want to be in the dock.

- How to get a mortgage to a single mother In the public mind a stereotype that a single mother is a poor woman raising a child alone, barely making ends meet, and to buy their own homes, she is simply impossible. In reality, however, single mothers have a real opportunity to buy an apartment or a house, particularly in mortgages.

- How to issue a mortgage in Sberbank The mortgage in Sberbank is provided on mutually beneficial conditions with convenient payment schedule and the minimum overpayment on the loan. This organization attracts a large number of the population. To obtain a loan in the short term for individually tailored program.

- What documents are needed for tax deductions on the mortgage The taxpayer has the legal right to reclaim part of the funds paid on mortgage loans. And be refunded as part of the amount spent on the purchase of housing and payment of interest on the loan.

- What documents are needed for payment of interest on the mortgage Those who bought an apartment in the mortgage, you can receive a tax deduction as the value of the property, and paid interest. It is necessary to provide the tax specified documents.

- Income tax refund when buying an apartment in the mortgage In accordance with the law, the state gets 13% of the cost of real estate purchased under mortgage loan. In fact, this return of income tax monthly withheld from wages.

- How to reduce interest on the mortgage Borrowers who took out a mortgage a few years ago appears to be at an extreme disadvantage. Indeed, over the past five years, interest rates on mortgages decreased from 14-16% to 11-13%. On the other hand, these borrowers always have the opportunity to revise the terms of lending and reduce interest rates on the loan.

- How to get a subsidy for the repayment of the mortgage On the territory of the Russian Federation and the regions has a number of programs for the design of incentives for mortgage lending, thanks to which people can apply for the purchase of housing and get mortgage loan subsidy.

- How to get a month to get a mortgage The size of the borrower's income is one of the most important factors influencing dobroesti mortgage loan. It needs to be sufficient to meet the obligations under the mortgage.

- You need to get a mortgage It is quite difficult to collect the full amount to buy their own homes. In this regard, a very popular option for the purchase of an apartment or home without long waits is a mortgage lending. This opportunity provides the majority of the existing banks, and the conditions for obtaining a mortgage loan they are practically the same.

- How much income needed for mortgage The financial condition of the borrower is one of the key factors that influences a Bank's decision about granting a mortgage. So to evaluate your chances of getting a loan can be based on the comparison of own income and the minimum required for a mortgage approval.

- Which banks give mortgages with no down payment Today, many banks offer the possibility of acquiring home mortgage with no down payment. Despite the fact that conditions are less favorable than in the classical mortgage, the borrowers agree to them. Because for many such a loan is the only opportunity to buy their own homes.

- How to calculate mortgage payments In the mortgage agreement contains a calculation of future payments. However, it is better to take care of the calculations in advance. This will allow to compare own financial capabilities and the amount of monthly payments, as well as to evaluate the profitability of deals on the mortgage.

- Why the savings Bank denies mortgage In the case of a negative decision on granting a loan, the savings Bank is not obliged to give reasons. However, to assess their chances of the borrower before processing the mortgage. It is enough to analyze the most likely causes of failure.

- How to get a mortgage with no down payment The presence of the initial payment (at least 10% of the total) in most cases is a mandatory condition for obtaining a mortgage. But borrowers such funds is not always available.

- How to get a mortgage and that to do this Question purchase their own homes is of concern to many. Not always it is enough of a savings, sometimes you have to go to the Bank and get cash loan. After receiving a positive response from the Bank, can choose apartment according to your taste.

- What documents are needed for a mortgage in Sberbank The housing issue remains relevant and painful for many citizens. To address part of it helps Bank mortgage loan, for which you need to provide the necessary documents.

- Why can refuse the mortgage You have chosen a Bank and going to apply for a mortgage. You must understand that you need to organize the Bank as a borrower. First you need to apply for a mortgage. This is to ensure that banking services could consider your candidacy.

- How to get a mortgage for buying house Today, borrowers have the opportunity to take mortgage lending for the purchase of the apartment, but to buy a private house loan. However, to the approval of the Bank in this case will be more difficult, since such lending is associated with increased risk.