Insurance

- How to obtain medical policy in Moscow To receive the insurance policy of obligatory medical insurance (OMS) to Moscow you must be registered in the capital at the place of residence or stay. If you have neither one nor the other, but you work under an employment contract in a company with legal address in Moscow, a policy you are entitled to, but the procedure for its execution will be different.

- How to calculate car insurance Many motorists have wondered whether it is possible to calculate the cost of compulsory insurance of your car, in other words - the cost of insurance. This amount, it is desirable to count to a contract with the insurance company to determine what amount of insurance premium you can expect.

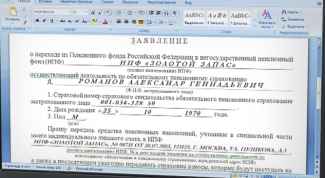

- How to change the pension Fund If after reviewing a letter from the Pension Fund of Russia or its non-state pension Fund (NPF), you are dissatisfied with the accrued interest on the funded part of their future pension, go to another NPF. Submit an application before 31 December of the current year and April of next year, the fate of your pension contributions will dispose of another organization. If her job does not suit you — choose the third etc. Or go back to the state pension Fund.

- How to calculate interest on insurance premiums For the calculation of fines for insurance contributions will need to source data such as date of occurrence and the planned repayment of debt, arrears and the refinancing rate in the period from the deadline for payment of the premium until the day when he was actually listed in one or another extra-budgetary Fund.

- How to calculate the payment for CTP The result of each traffic accidents are necessarily negative consequences in the form of damage to property, health or life of citizens. Redress is made by insurance companies insured the liability of the owners.

- How to calculate insurance premiums For the calculation of insurance contributions to the pension Fund and for reporting must be verified on the website of the Pension Fund's rate for the current year.In 2011, they amount to 26% for pension insurance and 5.1% for medical insurance.

- How to get money for insurance CTP – compulsory third party liability insurance provides for the insurance of your liability to third parties. This means that in the event of an accident the insurance company of the culprit makes restitution to the injured party. The perpetrator of the accident for insurance payments count is not allowed. It would seem that truth is on the side of the victim in an accident, and payments for CTP – is a self-evident consequence. But the receipt of payments associated with a considerable number of formalities, which the aggrieved party must follow literally from the moment of occurrence of the insured event.

- How to change an insurance policy in connection with the name change To new mandatory health insurance policy in connection with a change of name in the office of the insurance organization having the license for implementation of OMS.

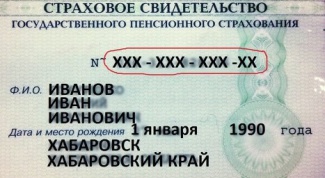

- SNILS - why and how does the The current pension system in Russia involves a personalized accumulation of future pension individual pension account for each insured citizen.

- How to get the money back for the hull What is the hull, now knows almost every driver. This insurance of a wide range of motor risks. Hull means the insurance of your car from theft, road accidents, various natural disasters, and insurance directly to passengers and the driver from various accidents, while they will be in the insured car. In order to return the money for the hull, it is necessary to follow clear instructions.

- How to calculate the insurance part of pensions In 2002, the government of zapusti new reform, radically changing the system of calculation of pensions. To understand it pretty easy. But people in 20-30 years will experience the results of this law, it is important to know on what basis will count the insurance part of their pensions.

- How to fill out a form to report the pension Fund Quarterly, based on accounting data, documents in the Pension Fund of the Russian Federation often causes some difficulties. To facilitate this important process is designed special software.

- How to calculate the insurance premium Insurance premium (insurance contribution) is the cost of the insurance, the policyholder pays to the insurer. In other words it is the price for the services of the insurer from the client to the case, if there is an insurance event.

- What is the insurance deductible Those who have to deal with insurance companies, have repeatedly heard the word "franchise". Many are puzzled when an insurance agent or Manager in the office offers to make the franchise when signing the insurance contract. What is it? This is a useful feature or some clever Ruse?

- How to sell insurance product The insurance product is different insurance offers coming from insurance companies. In rare cases, the man himself calls the insurance company to insure yourself or your property. That is why there are many insurance agents who sell these products.

- How to return the insurance money Any insurance contract can be terminated prematurely and return part of the money paid for insurance. For this, you will need to contact the insurer with the documents corresponding to the contract.

- How to calculate the insurance indemnity In addition to the mandatory third party liability insurance (MTPL), in our country there are the voluntary types of insurance. The most popular of them is the only insurance of vehicles (KASKO – from the Spanish "building") and real estate damage. The compensation you can receive in case of insured event.

- Where to pay insurance premiums The transfer of insurance contributions to extrabudgetary funds is the prerogative of the employer who performs it for the benefit of employees. These tools allow to cover various social needs of workers

- Most reliable insurance companies in Russia In the modern insurance market has a huge number of companies. Some have many years of experience, others are competitive only within a few years. The bankruptcy of the insurer, may bring a lot of inconvenience to policyholders, so the reputation of the chosen company, it is necessary to ask in advance.

- How to get SNILS SNILS - certificate containing information about the individual account. This account is used by the FIU for the formation of pension savings. For him, the employer makes contributions for the employee's future retirement.

- How to calculate hull Before placing the hull on your car, you should review the tariffs of the insuranceoffered on the market modern car insurance to use the services of the company where the price will be minimal.

- How to pay insurance premiums Call insurance premium payment (single or recurring), which is obliged to carry out the payer in favor of the insurer. Payment forms the material basis for protection of property and other risks.

- How to repair the damage for insurance When applying damage to the vehicle or other insured property the insurance company reimbursed the amount set out in the contract for insurance. To obtain the losses incurred from the accident the property owner is notified insurance company in writing. When the culprit of the accident is the second participant of road accident, the loss is indemnified by his insurer.