Instruction

1

To check the balance of your Bank account when transferring money to the card in several ways: with the help of ATM, cell phone or the Internet.

2

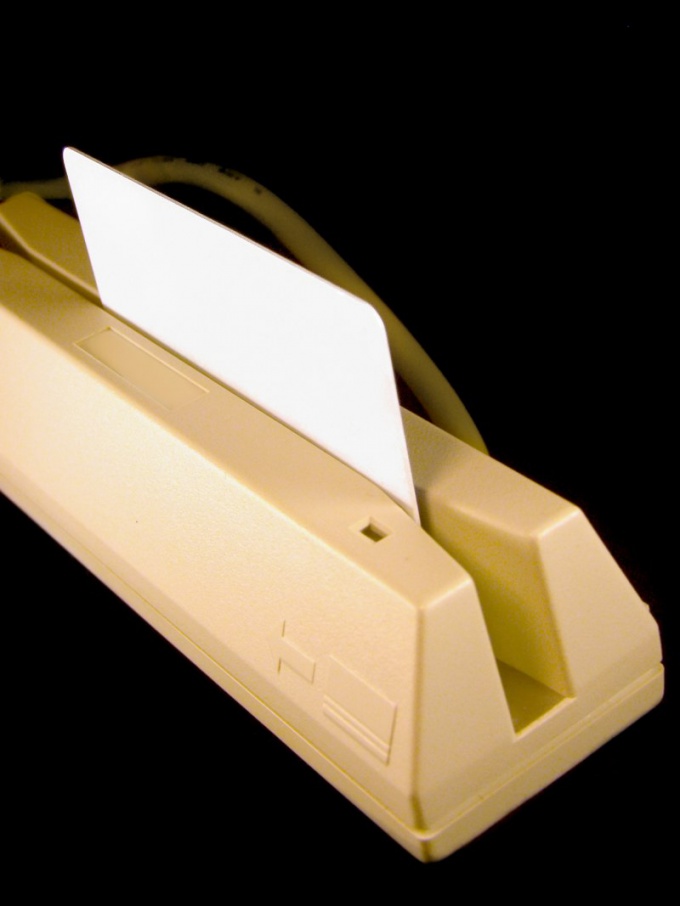

Viewing cash flow by using the ATM of "your" Bank is the most common. Insert a plastic card into the machine, choose from the suggested menu mini-statement of last transactions on the card account and view the result on a printed receipt. For this service, some banks charge extra.

3

The following method is the control of transfers via a mobile phone. In large banks there are special mobile services (for example, "Mobile banking" from Sberbank of Russia) and all changes on the account will come to you in the form of SMS messages. When connecting to this service will be charged the monthly fee, but after two months of use.

4

Online services on the websites of banks are another method of checking the transfer on a plastic card. To connect, you need to apply in the Bank or register on the website. You will then receive a user ID and password. They are required to log into the system as when connected to the service, so when you access the system without a connection. After completion of all operations you will have access to all information on the map.

Note

Mobile service and online service allow you to manage the account is not worse than using an ATM. You can pay the loan, to transfer money to another account, recharge mobile balance and many more. A huge plus is that this can be done in convenient time, without leaving home.

Useful advice

If you are unable to access mobile banking and online service, you can monitor the enumeration of the "grandfather" method. Record in a notebook all the receipts and write-offs on credit card. If the balance of the calculations agree with the balance on the alert, so all right.