Instruction

1

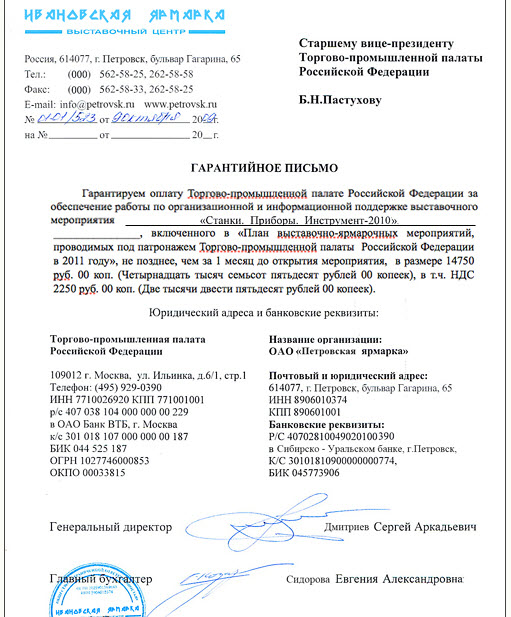

Make a guarantee letter on the letterhead or put the corner stamp with a completed company details (name, form of ownership, Bank details and physical address). Register the letter as an outgoing document. In the upper right corner, specify the details of the recipient (full name of organization, position and name of the head).

The letter may include a request for the delivery or the performance of services and to ensure their timely payment. In this case, it will begin with the words "Please do" and the last paragraph of the report "Payment guarantee". For emails that only contain a guarantee of payment, the beginning will "Guarantee payment".

The letter may include a request for the delivery or the performance of services and to ensure their timely payment. In this case, it will begin with the words "Please do" and the last paragraph of the report "Payment guarantee". For emails that only contain a guarantee of payment, the beginning will "Guarantee payment".

2

Next, list the goods or services that were the subject of concluding a bilateral agreement. Enter the transaction amount in figures and words and terms of payment of these amounts. At the end of the document is mandatory enter the full name, Bank details for transfers and legal address of each party.

Send a letter for signature to the head. In some cases, signed by the chief accountant. Reassure their signature print.

Send a letter for signature to the head. In some cases, signed by the chief accountant. Reassure their signature print.

Note

Document guarantee of payment is legal with the right design. That is, the full details of the parties-the contractors, the phrase "payment guarantee", the signatures of the leaders of the organization.

Useful advice

Since the form of such letters is not standardized and approved by any legal acts should be followed in the design style adopted for the other business letters.