Was individuals

Individual can register themselves by submitting an application to the tax office. However, if a person does not show initiative and will not be registered as a taxpayer, the tax office has the right to put that individual on the tax account without his participation. This procedure is based on the information received from the bodies listed in article 85 of the Tax Code of the Russian Federation. Such information can provide the registration authorities involved in the registration of citizens on place of residence; authorities issuing or replacement passports, etc.

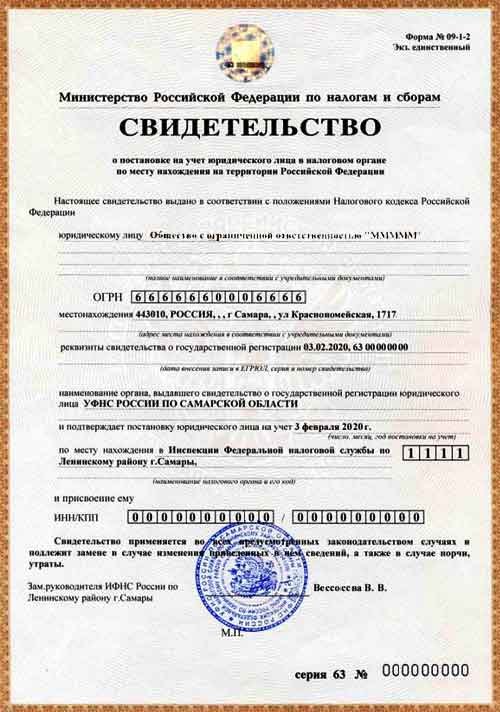

Citizen is entitled on application to obtain a certificate of the INN, which is a document evidencing his registration as a taxpayer. Receiving a testimony from an individual who is not an individual entrepreneur - is voluntary.

Under the legislation, the lack of evidence was a citizen is not considered a violation.

Natural person non-entrepreneur can pay taxes, without having on hands of the certificate on statement on the tax account. By law a citizen for tax purposes is not obliged to provide your VAT number when filling out tax returns.

With regard to situations when the employer requires the employee testimony was – such a requirement is not legitimate. Labour law, the certificate on statement on the tax account does not apply to the documents required for the conclusion of an employment contract. The exception is a separate category of workers, which must provide the witness was at the place of work.

A category of workers who are obliged to provide evidence of the INN, staff, civil servants, heads of organizations, chief accountants.

Was individual entrepreneurs and legal entities

When opening your individual enterprise using the private INN of the entrepreneur. If earlier the businessman was not on the account in tax inspections as a physical entity, it must apply for registration to the tax authority.

If the individual receives a certificate INN on their own, the individual owner needs to obtain this document in mandatory. The copy of the certificate attached to the application for registration. In the payment of taxes by an individual entrepreneur was used instead of personal data.

Legal person upon registration is also assigned to INN, which belongs directly to the organization and not the individual. Obtaining the certificate of legal entity as in the case with PI, required.