You will need

- To was quite simple. Contact the tax office at the place of residence. With them you will need to have a passport and a passport copy.

Instruction

1

Passport. This is the basic document of the citizen of the Russian Federation, and, in fact, only he will need when managing. Every citizen, from 14 years of age, can independently to INN if necessary. If in your passport there is no information about your registration, you will need proof of your residence.

2

A copy of the passport. Make sure you had a copy of the passport, you will need it. Better to do it in two instances. If you don't have a copy, you either have to find where to do it, or you'll make the tax, but at exorbitant prices.

3

A statement in form No. 2-2. This form will give you already in the tax, there is also a sample for filling.

4

If you changed the name of marriage, take the marriage certificate and its copy.

5

To obtain the INN for a minor child who is not yet 14 years old, you will need: the passport of the child's parent or legal representative and passport copy, birth certificate of the child. If not listed in the certificate, the citizenship, you need proof of citizenship.

6

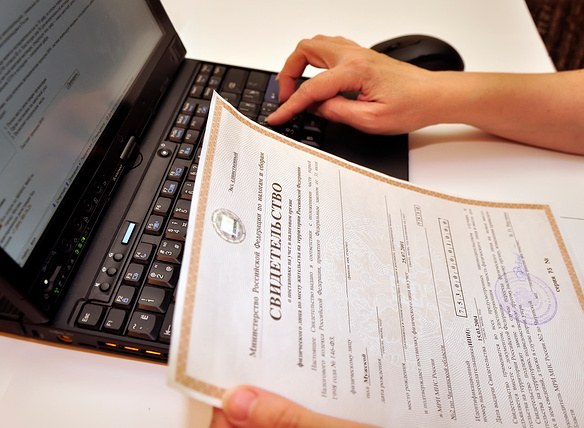

INN you will be able to obtain within 5 working days after submission of the application. INN is free. If the certificate was lost, to restore it you will have to pay a fee.

Note

INN is the identification number of the taxpayer. It is required to obtain from the time when one begins to work, begins its business or conducts operations that require the payment of taxes. Only in rare cases was the need to minors. INN may be required when applying for a job in some organizations, for presentation to banks, if you are making transactions related to the payment of taxes. Was assigned once and for all life.

To was can any citizen of the Russian Federation, but receiving it voluntarily. Nobody has the right to charge you was if to you do not want it. The exception among individuals applies to all civil servants and entrepreneurs. Legal entities are obliged to have tax.

Apply for a tax number, you can not only personally to the tax, but also through the Internet or by mail. But to get the certificate still have to personally or through a legal representative.

To was can any citizen of the Russian Federation, but receiving it voluntarily. Nobody has the right to charge you was if to you do not want it. The exception among individuals applies to all civil servants and entrepreneurs. Legal entities are obliged to have tax.

Apply for a tax number, you can not only personally to the tax, but also through the Internet or by mail. But to get the certificate still have to personally or through a legal representative.

Useful advice

Don't forget to make copies of all documents before going to the tax. Even if some copies are not necessary, better to have them with you than to stand in line several times.