You will need

- - passport;

- - the application for a taxpayer identification number.

Instruction

1

INN is a taxpayer identification number consisting of 12 digits. From these figures you can get some useful information. So the first two digits are the designation code of the Russian Federation. The next two digits – the number of local tax Department, then reaching six digits — the number of the tax record of the taxpayer and finally, the last two "check digits" that are present to verify the record.

2

To INN, you need to apply for registration in Federal tax inspection at the place of their residence. This can be done in several ways. You can visit the tax office personally. You must carry your passport (or other identity document). You can also send your application by registered mail with return receipt requested. While your statement is certainly attached notarized copy of the document proving the identity and confirming your registration at the place of residence. Most likely, in this case, you will also use the passport.

3

In addition, submit an application for a taxpayer identification number on the official website of the Federal tax service. When making a request through the online service you need to pinpoint important private data: basic information about you, your nationality, details of passport (or other identity document), relevant contact details and your e-mail address.

4

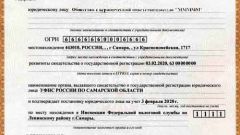

Within 5 working days after receiving your claim, the tax inspection has to put you on the account as an individual, then enter data in the Unified state register of taxpayers (egrn) and then give you the certificate on statement on the account in tax Department in territory of the Russian Federation. In practice, however, the exact period for issuance of documents depends on the particular tax Department. Some of them can give the finished INN and 20 minutes.

5

The tax authorities usually notify the citizen left the contact information that was (or rather certificate of registration) is done and waiting for its owner. It remains to obtain the finished document. You can do this either by personally visiting the tax Inspectorate at the place of your residence (or tax inspection at the place of your stay – if you have no fixed abode on the territory of the Russian Federation) or by visiting a legitimate or authorised by you representative.

Note

INN can only be obtained once in a lifetime. So if in the future you lose the original certificate, you will be given a copy, however, your taxpayer identification number will remain the same. Also if in the future you change your place of residence, surname, name, patronymic or even the floor - you will always have your old room.