You will need

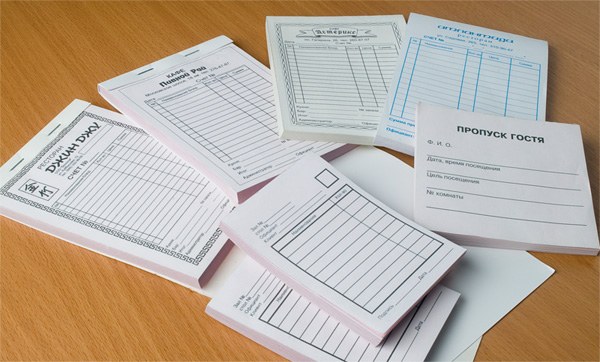

- - reporting forms;

- - the book of account forms.

Instruction

1

Find out what papers belong to the forms of strict accountability (BSO). BSO are the documents that can serve as a substitute to cash a check. These include tickets, tickets, various receipts, and so on. All of them must use and take into account special rules.

2

Make a book for accounting forms. It should consist of separate sheets stamped with page numbers. Pages should be sewn with a thread that you want to consolidate paper glued on the back side of the book. On paper shall bear the stamp of the organization and in such a way as to insert new and delete old pages of a book was not possible without compromising the integrity of the press. Also next to the stamp of the organization should be the name and signature of the responsible employee. Also indicates the number of pages in the book accounting, in order to avoid withdrawing and replacing sheets with data.

3

Correctly fill a book. It should include all forms of strict reporting, as well as their numbers, series and titles. This data is best recorded in a table. There is and officially accepted form of accounting, which can be learned from a number of orders of the Ministry of Finance. But this form is not mandatory. For example, you can record the number of forms on a daily basis or less frequently depending on the conditions of work of the organization.The book specifies a number of available forms and their reception and transmission. Each such event shall be signed by the employee responsible for the storage of such documentation. It must be concluded a special agreement on liability. When sending documentation compiled by a special act, which is usually stored together with the book of account.

4

Periodically the accounting of forms of the strict reporting, referring to the book. Inventory should be drawn up an inventory, which should be stored with the workbook.