You will need

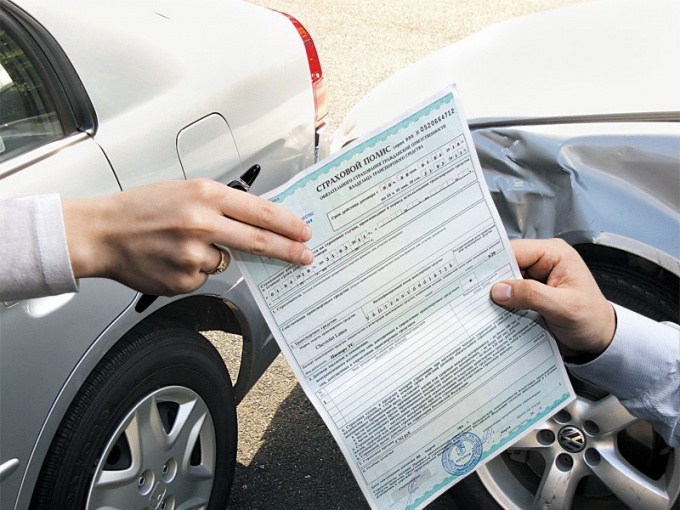

- - a valid insurance policy;

- - passport and the right new driver

Instruction

1

In any case, do not make self-corrections in the policy. Any changes in insurance coverage are allowed to only do the employee of the insurance company. Otherwise, to compensate for a self-made driver, the insurer will not. But the autopsy by the police of the fact of fraud will be detained for forgery.

2

For making changes in insurance, visit the insurance company office or call an insurance agent at home. In this advance, prepare the insurance policy, and a document certifying the personality of the new driver and his driver's license.

3

To enter a new person in the policy also required the presence of the owner of the vehicle or from his General power of attorney. This is a purely formal requirement, but mandatory.

4

Complete the application to change the list of drivers. On the basis of this document will be amended in the database CTP. Then the insurance agent will make all necessary changes to the policy or write a new one. Please note: all changes must be signed and stamped by the officials of the insurer. Although most insurance companies will simply issue a new certificate (the duplicate).

5

Make the policy as many drivers as you want without restrictions. Even if the number of entered drivers will be more than 5, refuse the requirements of the purchase of the policy without restrictions. With a large number included in the policy the person insurance agent shall apply to the additional insurance document showing all authorized persons. Either print this information on the reverse side of the policy. In any case, always make sure that you have the stamp and signature of the authorized person.

6

The procedure for incurring new face free. But when you change the degree of risk or loss discounts for trouble-free, the insurer has the right to demand surcharges to the cost of the policy. Detailed extra find out in advance by calling the office of the insurer. In addition, request a written calculation of the insurance premium payable upon the refinement. This will allow to independently verify the correctness of the calculations of the insurance company, if for any reason you don't trust her.