Instruction

1

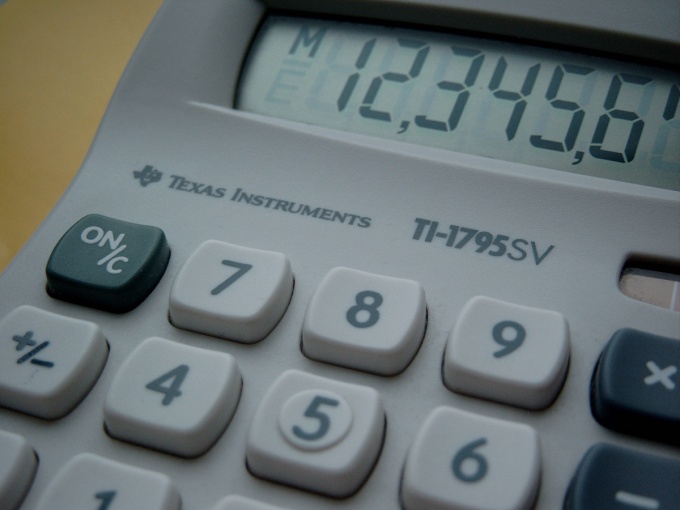

Clearly specify the problem statement. We need to find 7% of the number 594.

2

The digits on the calculator number, which is necessary to calculate the interest. In our case, the dialed 594.

3

Click the "X" button. Is - the button for multiplication. Do not confuse it with the " + " button (add).

4

Enter the percent. In our case, type the number 7.

5

Click the "%". This is the letter of interest. More than anything don't type it, no characters "=" (equals). The calculator immediately shows the calculated value. In this case, the figure turned 41,79. Thus, 7% of the number 594 = 41,79.

6

Click "S". This is the reset button, it is highlighted in a different color. The calculator will display zero and you can do the following calculation.

Note

Do not use calculator which works intermittently. Calculator - working tool, the correctness of the testimony which much may depend. Purchase once a good device that will last you for years to come. Reliable calculators are produced by well-known companies producing electronic equipment.

Useful advice

Sometimes check calculate a normal column, not to forget how to count. After all, at hand may not have a calculator. You don't have to get into an awkward situation. Remember that simple calculators built into cell phones.