Often the desire to ride on a new car makes people do stupid things. Not taking into account its financial position, a person buys a new car on credit. After a while he couldn't pay and he sells cars. To avoid this you must select the correct loan, and also to prepare financial protection.

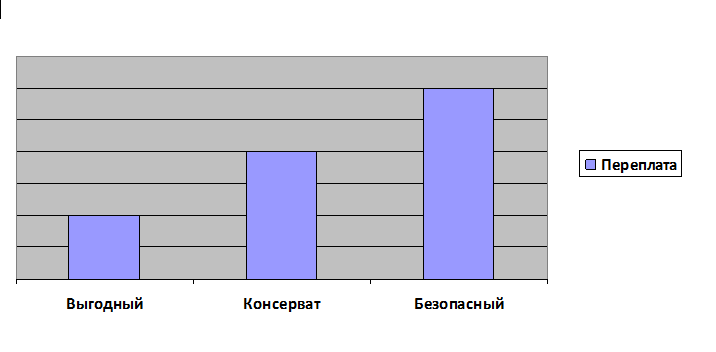

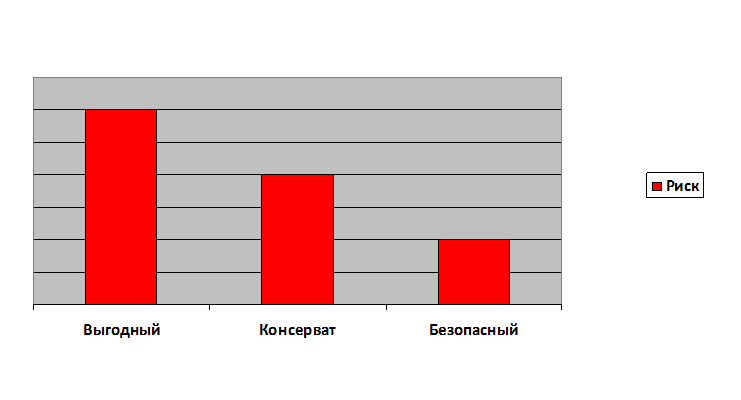

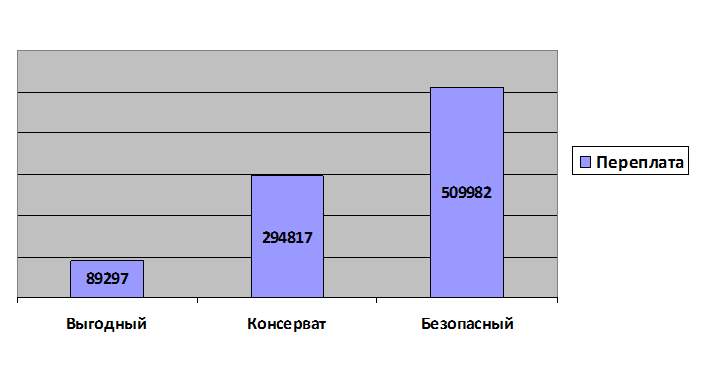

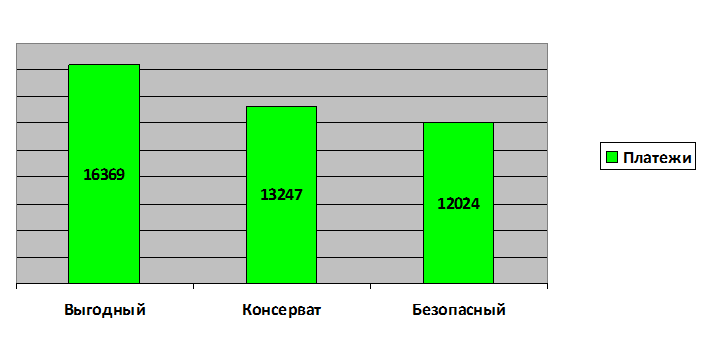

When choosing a loan, I recommend you consider 3 options. This advantageous loan conservative loan and secure the loan. The amount of the overpayment on these loans is different. Favorable credit has a slight overpayment, but a higher risk. Safe credit will allow more to live in peace, but interest payments will be significant.

Let us dwell on each option. For the calculation consider the car cost 1 000 000. Will not consider aggressive loan option when you have the hands of only 100 000 rubles, and the remaining amount of the loan. Not everyone can pull monthly payments in the amount of 30 000 rubles. The most properly and intelligently will save a certain amount of money, and only then apply for a loan. Let's say you sell your old car and put money. And your capital is 500 000 rubles.

Favorable credit is issued for a shorter period, consequently high monthly payments. Due to this, the overpayment will be minimal. Under short term loan you need to consider the time period up to 3 years. The best loan is an auto loan, since the interest on the loan is significantly lower than that of consumer credit. Usually when making an auto loan, it is necessary to design the hull. But there are banks in which the design of the hull is not a prerequisite. Auto loan is the best loan with minimum interest and a small overpayment.

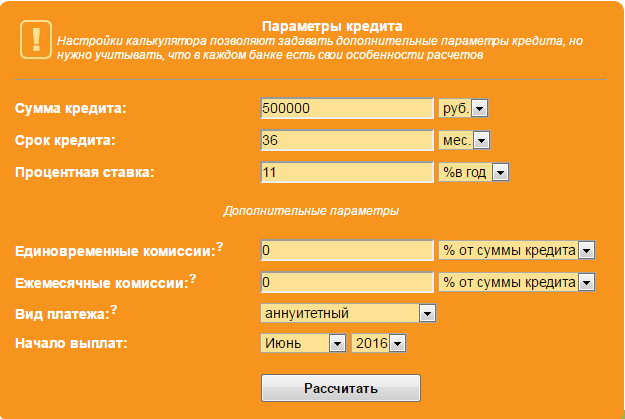

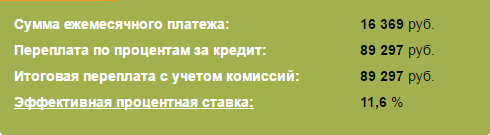

To calculate use loan calculator on the website www.calculator-credit.ru. Enter the following parameters: the loan amount is 500000 rubles, the loan period is 36 months, interest rate 11%.

Monthly payment will be 16369 roubles, the overpayment interest will be 89297 rubles.

When making an auto loan, remember that the machine will be pledged to the Bank, so to sell you can not.

Now consider the conservative type of loan. This option will suit the greater number of citizens, as it has a not high monthly payments. The payment amount is reduced by increasing the loan term to 5 years. For this period give only loans. To obtain the best interest rates contact the Bank that gives you a salary. Typically, those customers have special loan programs and you will get favorable terms.

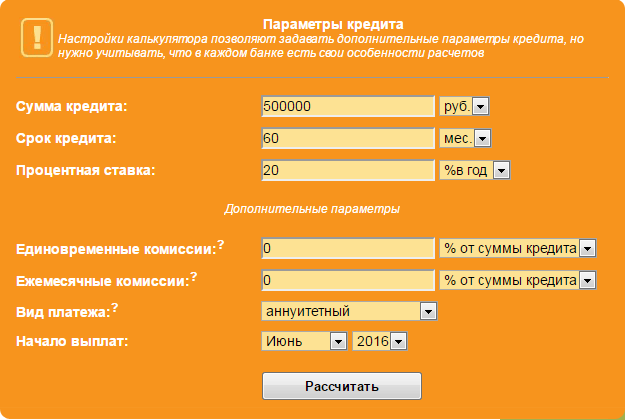

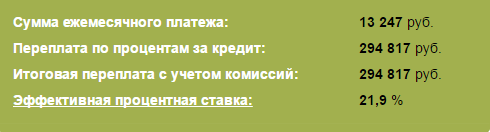

Enter in the loan calculator the following parameters: the loan amount of 500,000 roubles, term of loan 60 months interest rate 20%.

Monthly payment will be 13247 roubles, the overpayment interest will be 294817 rubles.

Such a loan is less than the monthly payment and your vehicle will be pledged to the Bank.

The third type of loan is safe. Suitable for persons with low incomes, or who do not want to quickly extinguish the loan and free money to spend on other needs. Select the Bank that will issue the consumer credit for a longer period, for example, at 84 months. Due to this, the monthly payment will be even less. However, the interest rate increase. The total overpayment interest will be greater, but you will be safer. Such a loan is more flexible because you can manage your payments. That is, for small monthly payment you can always pay more money on the loan and save on interest. And when your income falls, you can return to the minimum payment amount.

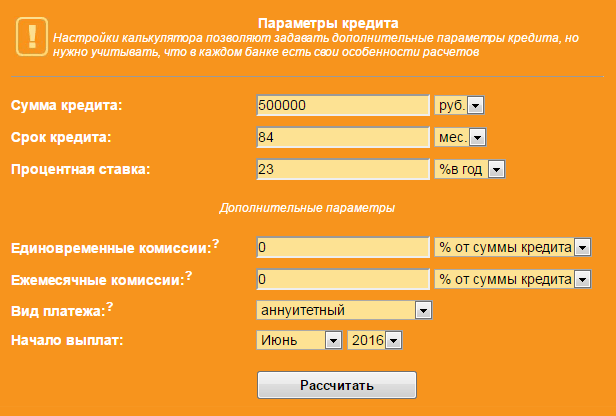

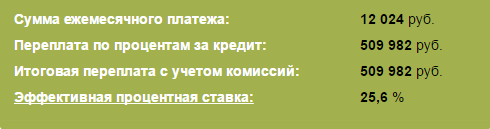

Enter in the loan calculator the following parameters: the loan amount of 500,000 rubles, the loan period is 84 months, interest rate of 23%.

Monthly payment amount 12024 roubles, the overpayment interest will be 509982 rubles.

In the end, the overpayment on the loan will be huge, but you have less monthly payment and don't forget about inflation. After 7 years, the money will be worthless, and to give you the money have a different weight.

Now compare all three variants of the loans.

When selecting a loan rate its financial position. Calculate your income and expenses. You will be able to pay the best loan? If the payments will take away all your income, think carefully about whether to risk and take such a loan. Saving money is very good, but to take such a loan when the reserve does not have money will be the wrong decision. Think about what you will do if your income will decrease, and will pay nothing. To sell a car will not work, as it is in the pledge.

When making any loan you need to assess your risks and know what to do with the fall of the basic income. Suggest to prepare financial protection. You need to create a cash safety cushion. If loan payments for you very large, it is necessary to postpone the purchase and to dig a little more money. Create a cash reserve in the amount of 6 monthly payments. Thus, you will have the amount of money that you can use in the most difficult times.

This technique can be used for any value of the car. Enter the desired value in the auto loan calculator and get the other results of calculation.

Remember that loan payments it's not all expenses when buying a car. Every year we have to pay insurance, taxes, buying spare parts and other current costs with the car.