You will need

- Receipt

Instruction

1

The commodity receipt is issued at the time of payment of the goods or services.

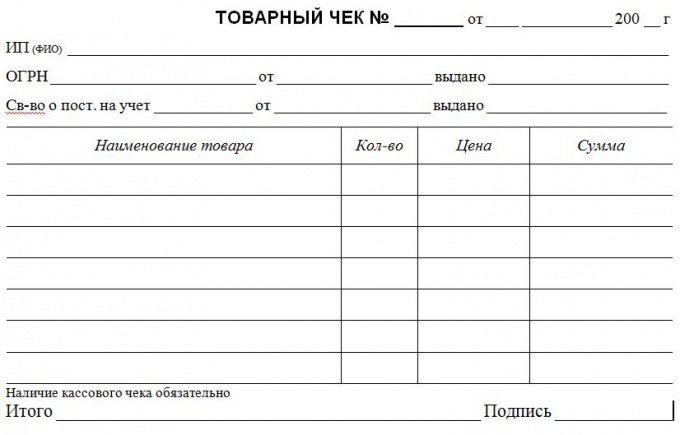

When making commercial check, you must specify its serial number and date of issue.

When making commercial check, you must specify its serial number and date of issue.

2

Next, you should fill in the data about the seller: name of owner, individually or the name of the organization; OGRN and the date of issuance; number of certificate of registration and its date of issue. When completing these data, the commodity receipt is valid without printing.

3

Next, enter the name of the goods or services, quantity, price and amount.

When making commercial checkand never use a generic phrase. For example, do not write: "Purchased fishing equipment in the amount of 1100 rubles." Each product is necessary to enter separately, for example: "a spinner for fishing rod 5 pieces for the price of 10 rubles; line 5 pieces of 10 roubles; fishing rod 1 piece at the price of 1000 rubles."

When making commercial checkand never use a generic phrase. For example, do not write: "Purchased fishing equipment in the amount of 1100 rubles." Each product is necessary to enter separately, for example: "a spinner for fishing rod 5 pieces for the price of 10 rubles; line 5 pieces of 10 roubles; fishing rod 1 piece at the price of 1000 rubles."

4

At the end of the document indicates the total amount on the document and put the signature of the responsible person. Printing when making commercial checkand set is not necessary if all columns of the document are filled.

5

To store the commodity check should be for the entire period for which the guarantee is given on the purchased product or service. The commodity receipt is the primary document, and therefore, the shelf life for it organizations is 5 years.