You will need

- receipt;

- - receipt;

- - accountable forms;

- - packing list/certificate of completion.

Instruction

1

Documents that must accompany any cash proceeds depend on the activities of individual entrepreneurs or companies, as well as on the applicable tax regime. When the total system (GTS) and the simplified tax system (STS) operates a cash method of recognizing income, so if paying by cash, you must issue the buyer with a receipt. At the same cash register that prints receipts, must have a fiscal memory and registered in the tax. To issue the receipts required for purchases of private and legal persons. In the latter case you will also need a waybill (if selling goods) or a certificate of completion (when providing services) and the invoice (if you are working on the BASIS and allocation in the cost of goods and services tax).

2

Often when cash payments than cash the check, give buyers and commodity, which contains detailed information about your purchases. His results are optional, but buyers are often asked to provide it. However, now in many retail outlets give out cash vouchers that contain items. Thus, the need for the issuance of invoices lost.

3

In some cases the individual entrepreneur or company can do without receipts and give customers the forms of strict accountability (BSO). Regardless of the tax regime. One copy is issued to the buyer, the second is the seller. This possibility is provided for individual entrepreneurs and companies which provide services to the population. For example, BSO include tickets, package tours, travel, receipts, purchase orders. BSO have an established form and shall be printed in the typographical way. Their results should be recorded in a special journal.

4

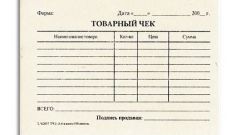

Entrepreneurs and on the imputed income can only give buyers receipts, and receipt of credit cash warrant (PKO). Receipts do not have a strictly prescribed form and do not have to be ordered from the printing house. Thus, receipts are not forms of the strict reporting. However, there is a list of details that must be contained in the bill of sale. It is the name and the document number, country of issue, data a PI or LLC (name, tin, bin or OGRN) name of purchased goods or services, the amount of purchase and signature of the person issuing the check.

5

Often there are situations in which the entrepreneur can combine the two tax regime in operation. For example, the company sells construction materials. When they implement to individuals that do at home repairs, their activity falls under vmenenku and they may be limited to issuing invoices. But when they sell goods to other entities in bulk, who buy them for resale, the seller is obliged to provide them with a receipt. In the latter case, its activity does not fall under the concept of retail trade, which is subject to imputed income and it should be applied STS or GTS.