Instruction

1

If your type of business activity under the legislation of the region where you actually carry out (the possibility of using this tax regime and rates of the tax law is fully placed in the competence of local authorities), gives the right to use UTII, you must register with the inspection as the payer of this tax. To do this you may even if registered as an entrepreneur within the subject of Federation, and the activities carried out in the other. Note that the parallel conduct other activities that do not fall under unified tax on imputed income and the acceptance of cash in connection therewith you must use the cash register, can simply punch in the amount received depending on the type of activity which pay the imputed income.

2

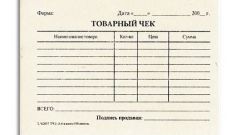

However, be prepared that at any time the buyer may require you have a document about getting money from him. And the right to refuse you have. However, the law is quite liberal in relation to the confirming document. If your product or service does not fall in the list of payment which must be confirmed by the form of the strict reporting, you are free to use any standard form of confirming document of the submitted in computer accounting and business programmes or to develop its own version.

3

Importantly, the document contained information such as name, number, date of issue, your name and INN name and the number of goods or works and services received for the amount and the name and title directly to the issuing person (or your seller). It is advisable to seal it in the presence of and signed.

4

A special case, if you previously used a cash register. After the transition to UTII in the case where there are no parallel activities in which the use of cash to you, you should immediately remove your cash register from the register. Otherwise, the tax Inspectorate may at any time to check your cash discipline, be fined in case of violations. In this case, the argument consists in the fact that the use of the cash you don't have you (while it's not removed from the records) will not help.