What is a receipt

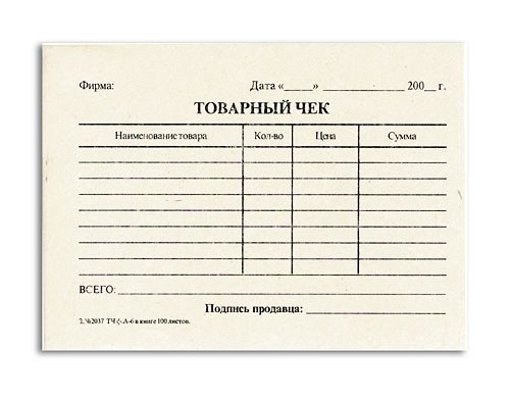

First receipt is necessary in order to protect the rights of consumers. Mandatory data receipt are: date of issue, name of the goods sold, the amount you paid the amount (cash or payment card), the name of the seller, a printing trade organization. If vendor has no seal, so on the bill of sale obligatory line was specified merchant.

When filling out the sales receipt, each product or service rendered must be indicated separately and not collectively. At the end of the receipt in the designated column indicates the result of the cost of services or goods, and better, if the record is in figures and words. If you purchased a single product, then the empty string negate in order to avoid additions.

What you need to know about the bill of sale

Have a sales receipt, there is no approved form, but the act lays down a list of necessary and mandatory details, observing that the entrepreneur has the right to choose their own form of this check.

Forms sales receipt can be printed independently on the computer and write by hand, but it is inconvenient both to the buyer and the seller – and lost a lot of time. Therefore, the computer is a special program that displays all the necessary information, and the receipt is printed on a normal office printer.

A receipt confirms your right to a refund or exchange of goods. Also a check is required to confirm the costs incurred by the accountable person or production of goods on a balance sheet. A receipt is a guarantee of their own money spent on the needs of the firm or organization where you work, and the last in time provides the report in tax service, thereby reducing themselves costs on taxes and increasing profits.

In recent years, the CMC issued a printout full of information on the cash receipt, and as if in such a situation, receipt is no longer needed. But it should be noted that for entrepreneurs under UTII, and working the old cash register receipt is the only document issued by the buyer when making a purchase.

Based on the sales receipt you can confirm the fact of payment of the goods. To avoid conflict, keeping in order your nerves and communicate with the contractor or seller based on the letter of the law.

One conclusion – do not throw away receipts, not leaving, carefully check whether all the details entered. Be careful in order to avoid unnecessary problems. Nevertheless, you should pay attention to the fact that the loss of the receipt or lack of, does not deprive you of the opportunity to return the product and get my money back.