You will need

- - the program "1C Accounting"

Instruction

1

Select the menu item "Inventory" Is "goods receiving". Select a specific operation by using the submenu "operation".

2

Specify in the document warehouse, which must be capitalized tangible assets. Specify wholesale, retail or warehouse NTT.

3

If you chose NTT, specify the retail price at which the product will be sold in NTT. Enter the price for the requisite "Rozn. Price (LCY)". The price you enter manually or calculate automatically from the "price posting" is specified in the props price. The percentage of trade margins is filled by default according the entered markup percentage. This percentage is contained in document "set price items".

4

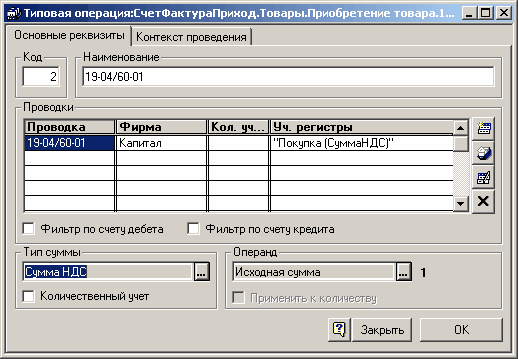

In that case, if your document shows a sign of reflection in the accounting becomes visible tab, the "Offset account". Specify on this tab accounts for the purpose of accounting and taxation. These accounts will be listed in the transactions as offsetting with accounts of the account item accounts.

5

If your document will be conducted at the accounting and tax account, the document will certainly specify the amount of the goods invoiced in the currency of the regulated account, it is necessary to make the requisite "Sum (REP)". Specify accounts and tax accounting.

6

If you are using the document the Posting of the goods" must not debit the goods and the equipment, for the item position in the requisite "batch Status", check the value of "Equipment". Then during the document will have a new batch of equipment, it will have the options of the party that you specify in the document.

7

The table "Posting of goods" will be filled in automatically in accordance with the document "Inventory of goods in the warehouse. You can keep a document based on the document "Inventory of products in stock" and can specify a document in the props Inventory, click "Fill". In this case, the tabular part of the document is filled with surplus items that have been recorded in the inventory document.