You will need

- calculator,

- - computer,

- data on wages.

Instruction

1

Generate the employee's payroll over the last exhaust them of the days of the month prior to dismissal.

2

The estimated wages, district factor and regional interest premium, edit the section "Notes–calculation", which is called "Calculation of payments", in counts 10 and 11, respectively.

3

Calculate compensation for unused employee vacation. To do this, you need to calculate the number of days for which on payments. Consider the formula: 36 days / 12 months. x = T, where C is the number of days since the last vacation, T - number of days for which it is reimbursed.

4

The calculation of daily earnings are based on a formula: A / 12 months / day 29.4 = B ; where a - amount of gross wages for the last 12 months, B - the average daily wage.

5

The final payment of the compensation produced according to the formula : T x B =, where T is the number of days for which it reimbursed, B - the average daily earnings And the final amount of compensation.

6

Store the received data in the section "Notes – calculation", which is called "the Calculation of holiday pay" and fill in all relevant columns from the first to the ninth.

7

The amount of vacation make in the box 12 and summarize the section called "Calculation of payments". To do this, calculate the following indicators : box 10 + box 11 + 12 count = count 13.

8

Calculate the amount of the tax to incomes of physical persons (13%) on the assessed amount of payment and enter this figure in column 14. If this figure came out with the cents round up to whole number.

9

Complete index for other deductions, the organization's debt to the worker, but also a duty of the employee to the organization (Graphs 17, 18). If the performance is zero, put a dash.

10

Calculate the total amount to be paid. In column 19 = column 13 – column 16 = total.

11

Fill in the details of the accountant, put your signature and date.

Note

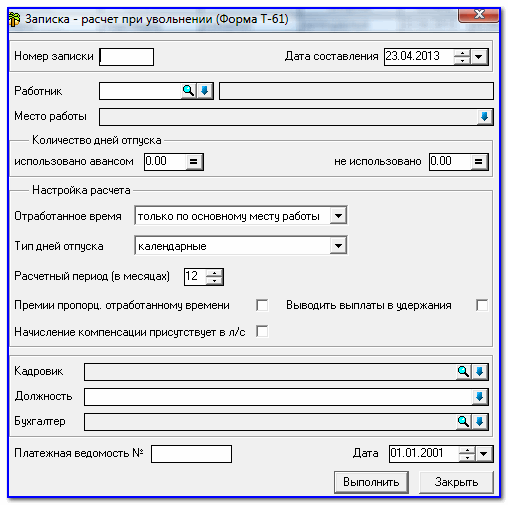

The example above can be used when calculating the payments manually on a calculator. In a special accounting programs the calculation is made automatically based on the entered data.