Instruction

1

Make charitable help only together with the correct submission of documents to the appropriate tax authority. A tax deduction cannot be more than 25% of the revenue received by the citizen for the term of the tax period (one calendar year).

2

Specify in the tax Declaration of the list of institutions for the use of funds from the proceeds spent on charity. The opportunity to receive a tax deduction is available in the following cases:

- transfer of funds for the needs of the organizations of education, culture, science, health, etc.;

- transfer funds to accounts of preschool and educational institutions, physical culture and sports organizations;

- transfer of funds to religious organizations in the form of donations.

- transfer of funds for the needs of the organizations of education, culture, science, health, etc.;

- transfer funds to accounts of preschool and educational institutions, physical culture and sports organizations;

- transfer of funds to religious organizations in the form of donations.

3

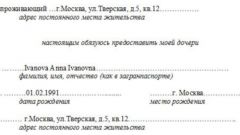

Declaration (form 3-NDFL) is served at the place of residence of the citizen and can be sent by mail. If the tax deduction is confirmed, the tax office will send you a written notice, stating the amount refunded. Then submit to the tax authorities a request for refund of overpayment of withheld tax. Specify in the application your account number and the amount of the refund. Into the specified account in the subsequent month must be received a refund.

4

For charitable donations between the two institutions or organizations (legal persons) make a contract in writing, which should contain information about a monetary donation. To unsubscribe from the donations donating can't that fixed in the contract.