Instruction

1

Makes sense first to take an interest in accounting will give you a loan, before to start its design. If prior consent is obtained, discuss with the chief accountant of the enterprise the conditions of its repayment. If you are satisfied, you must write the statement on the loan.

2

Take a clean sheet of paper of standard size. It is better if the statement is handwritten. Use a pen with blue or black ink, as is customary when writing official papers.

3

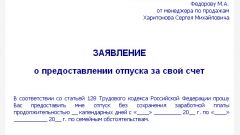

In the upper right corner of the sheet write the name head of your company, its name and initials. Then write "from" and name your position, Department in which you work, your surname and initials. The line below, in the middle, write with big letters the word "Statement".

4

In the upper right corner of the sheet write the name head of your company, its name and initials. Then write "from" and name your position, Department in which you work, your surname and initials. The line below, in the middle, write with big letters the word "Statement".

5

In the first line write the standard sentence "I am writing to request a loan in the amount of:" and enter the amount that you need. If necessary, enter the reason or purpose of the loan.

6

Write the conditions under which you want to receive money interest free or the interest rate at which the company can provide them to you. Be sure to specify the period for which you need money.

7

Indicate how you will make repayment of the loan. Most likely, you in the statement it is enough to write that you are asking to deduct the required monthly amount and the interest from your earnings.

8

Date of writing the application. Sign it and let the transcript, indicating all the names and initials. Take the statement to the office and register it at the Secretary. You will just have to wait for the decision.