You will need

- calculator;

- -relevant data across the enterprise.

Instruction

1

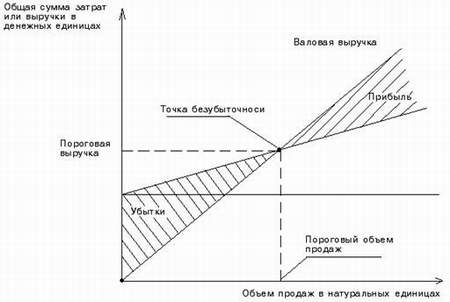

The breakeven point can be expressed in monetary terms and in physical size, i.e. the volume of production (pieces of goods or products). Depending on what expression you use, select the appropriate formula.

2

To determine the break-even point, divide costs into direct and variables. Straight lines do not depend on production volumes and the quantity of the committed products operations. Variables increase in proportion to production. The breakeven point of a company is very important for the lender, since the value exceeds the value of the break-even point is a measure of the safety margin, i.e. it shows how the organization is solvent.

3

If you think the breakeven point in monetary terms, use the formula: TBD=To*Spot(In-Sper), where LD is the breakeven point in terms of money, the proceeds from the sale, Spot fixed costs, Sper - variable costs.

4

If you think the break-even point in real terms, then apply the formula: TBN = Spot/(C-Ssper) where TBN is the break-even point in real terms, Spot - fixed costs, C is the cost per unit of output, Ssper - average variable costs per unit of output.

5

After identifying the break-even point calculate the margin of safety of the enterprise, as it is more objective than the breakeven point, the state record company. To identify the margin of safety in monetary terms, use the formula: PZ=(B-LDP)/B*100%, where PZ is the margin of safety in terms of money, the proceeds from the sale, LD the breakeven point in monetary terms. To identify a stock of financial durability in real terms, apply the formula: TPA=(Rn-TBN)/PH*100%, where the TPA - margin of safety in real terms, PH is the implementation in real terms, TBN - the break-even point in real terms.