Instruction

1

The pace of inflation is used to measure the intensity of inflationary processes, their dynamics along with the index of inflation. It characterizes the rate of depreciation of money and purchasing power for a certain period. The rate of inflation expresses the increase in the average price level in percentage to their face value at the beginning of the study period.

2

At the conclusion of long-term contracts it is necessary to determine the projected annual pace of inflation and the growth of its index. It is necessary to calculate the expected average monthly growth rate of inflation. This information can be taken in the published forecasts of economic and social development of the country in the coming period. The results of these forecasts that become the basis of subsequent factor analysis of inflation in the financial activities of the company.

3

The projected annual rate of inflation (TIG) is calculated according to the formula:

TIG = (1+Tim) n – 1, where:

Tim - the expected average rate of inflation in the upcoming period

n – the degree to which you want to build the number (1+Tim) equal to the number of months in the forecast period. If the period is a year, then n = 12.

TIG = (1+Tim) n – 1, where:

Tim - the expected average rate of inflation in the upcoming period

n – the degree to which you want to build the number (1+Tim) equal to the number of months in the forecast period. If the period is a year, then n = 12.

4

In this formula you can calculate not only the predicted annual rate of inflation, but the value of this parameter for any forthcoming period. For example, if a calculation covers a period of two years, the degree n, which erected a number (1+Tim) will be equal to 24.

5

The rate of inflation can be used to calculate the predicted annual index of inflation (IIG):

IIG = 1 + TIG or:

IIG = (1 + Tim)n.

IIG = 1 + TIG or:

IIG = (1 + Tim)n.

6

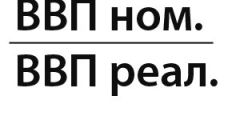

The pace of inflation is used to construct real interest rates, taking into account the factor of inflation. For this calculation, use the projected nominal interest rate in the financial market, which is usually reflected in the prices of futures and options contracts on the stock exchange. According to the Fisher Model, the real interest rate Ip is calculated by the formula:

Ip= (I – TI) / (1 + TI), where:

I – nominal interest rate (actual or projected for a certain period.

Ip= (I – TI) / (1 + TI), where:

I – nominal interest rate (actual or projected for a certain period.