You will need

- • Information about the balance of the savings book with a Deposit opened in Sberbank before 20 June 1991.

- • The calculation formula and coefficients

- • Information on the status of the contribution previously received compensation for the contribution.

- • Information about the age and nationality of the recipient of compensation.

Instruction

1

The right to receive compensation for deposits in 2011 have:

• Citizens of the Russian Federation until 1991 birth inclusive, and to their heirs born in 1991.

• The depositor's heirs or persons who have carried out payment of ritual services, if the death of the depositor came in 2001-2010 the Basic amount by which the accrued compensation is the remainder of the Deposit on June 20, 1991, the Calculation is made on the basis of the so-called face value of banknotes in 1991, i.e. 1 rouble 1991 is equal in value to 1 ruble of the current period.

• Citizens of the Russian Federation until 1991 birth inclusive, and to their heirs born in 1991.

• The depositor's heirs or persons who have carried out payment of ritual services, if the death of the depositor came in 2001-2010 the Basic amount by which the accrued compensation is the remainder of the Deposit on June 20, 1991, the Calculation is made on the basis of the so-called face value of banknotes in 1991, i.e. 1 rouble 1991 is equal in value to 1 ruble of the current period.

2

The accrual of compensation on deposits occurs in the following sizes:

Citizens of the Russian Federation until 1945 year of birth inclusive of the compensation paid triple the amount of the remainder of the Deposit.

Citizens of the Russian Federation 1946 – 1991 of a birth inclusive of the compensation paid to double the size of the remainder of the Deposit on 20 Jun 1991.

Citizens of the Russian Federation until 1945 year of birth inclusive of the compensation paid triple the amount of the remainder of the Deposit.

Citizens of the Russian Federation 1946 – 1991 of a birth inclusive of the compensation paid to double the size of the remainder of the Deposit on 20 Jun 1991.

3

Also, for calculation of compensation are subject to a number of factors:Inputs, current time, and the contributions closed during the period 1996 – 2011 - 1

The contributions operating in 1992 – 1994 and closed in 1995 - 0,9

The contributions operating in 1992 – 1993 and closed in 1994 - 0,8

The contributions operating in 1992 and closed in 1993 0,7

The contributions closed in 1992 - 0,6 Deposits closed for the period from 20 June 1991 to 31 December 1991 are not kompensiruet in the period of validity of the Resolution of the Government of the Russian Federation No. 1092.

The contributions operating in 1992 – 1994 and closed in 1995 - 0,9

The contributions operating in 1992 – 1993 and closed in 1994 - 0,8

The contributions operating in 1992 and closed in 1993 0,7

The contributions closed in 1992 - 0,6 Deposits closed for the period from 20 June 1991 to 31 December 1991 are not kompensiruet in the period of validity of the Resolution of the Government of the Russian Federation No. 1092.

4

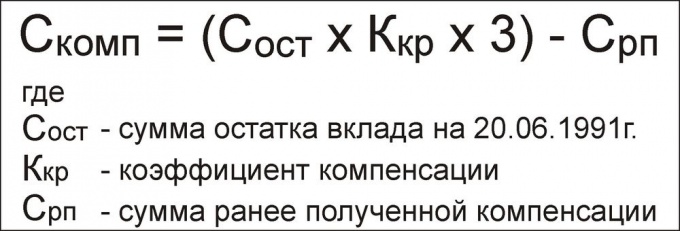

To calculate the final amount of compensation should have information on compensation received in previous years. Amounts deducted from the previous amount of compensation.

In the final formula for calculation of compensation in the triple size as follows (see image):

In the final formula for calculation of compensation in the triple size as follows (see image):

5

To calculate payment double digit "3" in the formula is changed to "2". Note that the heirs of the depositors compensation is calculated based on the age of the contributor, and heir to the contribution. Moreover, the heirs at the time of receipt of the payment must also be citizens of the Russian Federation as the contribution of the testator at the time of death. The heirs should have the document for the right of inheritance of the Deposit.

Note

For more information on compensation payments can be obtained by calling the information service of Sberbank of Russia 8 800 555 55 50.

Useful advice

On the official website of Sberbank of Russia opened an online service Calculator calculate compensation for Sberbank Calculator calculation of compensation." It is possible to get the link http://www.sbrf.ru/moscow/ru/person/contributions/compensation/. When all fields are filled correctly, the calculator instantly calculates the amount of compensation.