Instruction

1

With the experience of 5 years will be charged 60% of average earnings, experience from 5-8 years 80%, more than 8 years – 100%.

2

Maternity allowance will be calculated from average earnings over 24 months. The leaf of disability can be paid to all the places of work of the employee. Earnings divided by 730 days, not 365 as it was before. Time spent on sick leave and leave without pay, discharged from the sum of the total earnings. If, before maternity leave was leave to care for a child, for the calculation of average earnings it is possible to take another year.

3

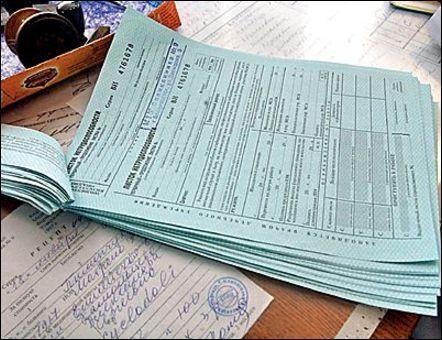

Introduced the obligation to issue the worker a help of a special form. They can be queried since 2009. When dismissing this certificate is issued is necessary. It indicates the amount of earnings and length of service for calculating benefits for temporary disability.

4

At the expense of the employer paid 3 day benefits, and not 2 days as it was before.

5

The amount of the allowance for sick leave may be accrued and paid by all employers at the place of employment of the worker.

6

If time is not, the benefit will be calculated on minimum wage.