Calculation of simple payback period

Method simple payback period is one of the easiest ways of evaluation of the project. To calculate this index it is enough to know the net cash flow for the project. Based on this calculated balance of accumulated cash flows. When choosing among several investment projects to implement the adopted project, whose payback period is the least.

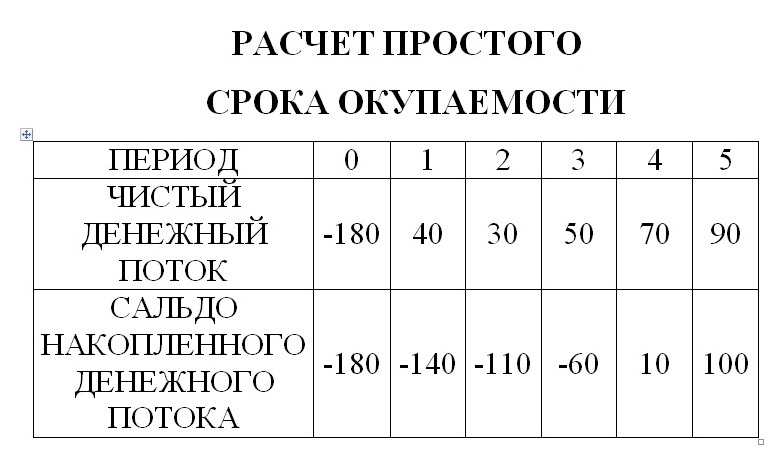

Assume that the initial investment in the project amounted to 180 million rubles. The project will be implemented within 5 years, it will annually generate cash flows:

1 year: 40 million rubles

2 year: 30 million rubles

3 year: 50 million rubles

4 year: 70 million rubles

5 year: 90 million rubles

It is necessary to calculate the simple payback period.

Using the data presented, it is necessary to make the analytical table. The payback period for the project is calculated by summing the annual cash flows as long as the amount of future cash inflows is equal to the magnitude of the initial investment costs.

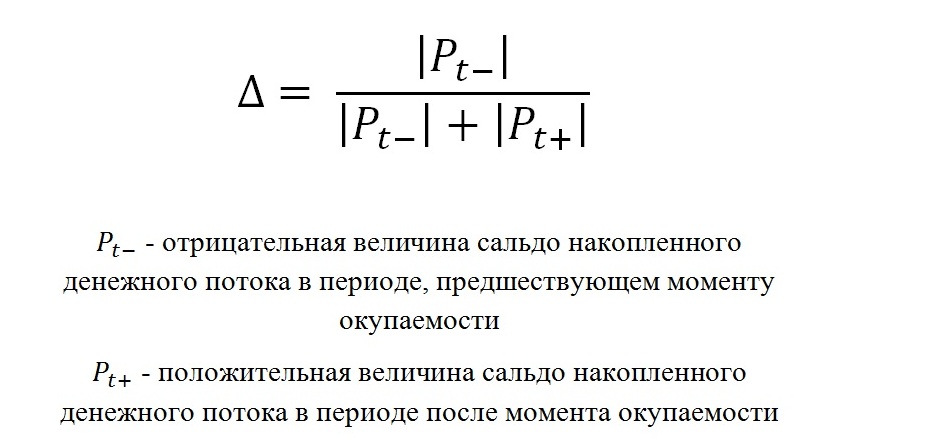

The table shows that the balance of the accumulated cash flow takes positive in the period between 3rd and 4th year of implementation of the investment project. To calculate the exact payback period will help the following formula:

In this example, the payback period is: 3 years 10 months

The main disadvantage of this method is that the calculation is not used, the procedure of discounting, and thus does not take into account the decrease in the value of money over time.

The calculation of the discounted payback period

Discounted payback period is the period for which the discounted cash flows to cover the initial costs associated with the investment project. Discounted payback period is always less than simple, as over time, the value of cash is always decreasing. The procedure of discounting allows to take into account when calculating the cost of capital employed.

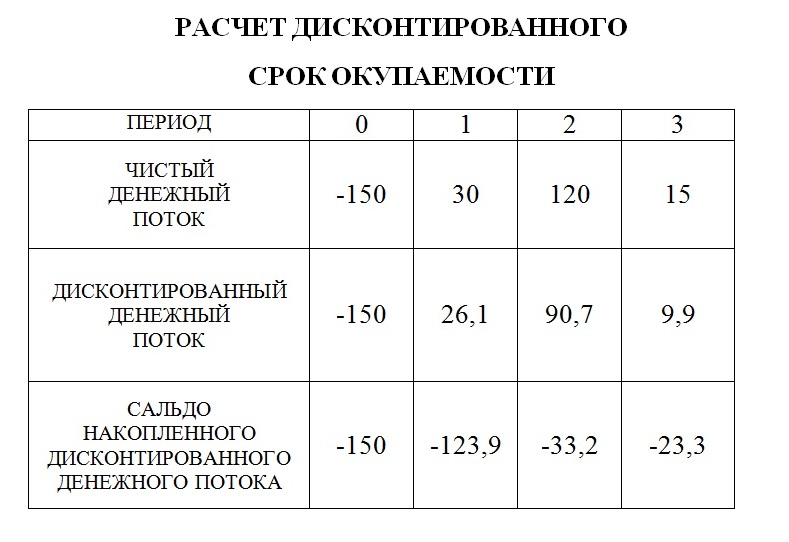

Assume that the initial investment in the project amounted to 150 million rubles. The discount rate is 15%. The project will be implemented within 3 years, it will annually generate cash flows:

1 year: 30 million rubles

2nd year: 120 million rubles

3 year 15 million rubles

It is necessary to calculate discounted payback period.

The presented data it is also necessary to make the analytical table. In the first stage is calculated discounted cash flow in each period. Discounted payback period for the project is calculated by summing the annual discounted cash flows as long as the amount of future cash inflows is equal to the magnitude of the initial investment costs.

The table shows that the balance of the accumulated discounted payback period does not take a positive value, therefore, in the framework of the project payback is achieved.