Instruction

1

Typically, renting means providing the object for temporary use without ownership rights, which is why fixed assets are recorded on the balance sheet of the lessor. If you are, then every month need to charge depreciation. The amount of deductions reflect on account 02 "fixed assets depreciation", which is credited to the account 91 "other expenses". Lease payments note on the account 76 "Calculations with debtors" in correspondence with 91.

2

In that case, if you are a tenant, then the leased property to reflect the off-balance account 001. And amount of payments under the contract note on the score of 19, opening to him are credited to the account 76.

3

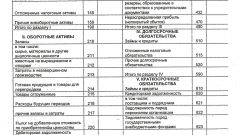

In accounting, the balance sheet (unified form No. 1) reflects the amount of fixed assets on the line 120, even in the case if you transferred them to other person under the lease.

4

In that case, if you are a lessor, the transaction for the transfer of objects, specify in Annex to balance sheet (unified form No. 5). The amount you write on the second page of Blanca, and there enter the amount of depreciation.

5

In that case, if you are a tenant, then leased assets also specify in the Annex to the balance sheet, only the line "of the Received fixed assets in rent".

6

In the tax records will reflect the operation under the lease. If you are a landlord, then the amount of lease payments will include the composition of other operating income, that is, it will increase the amount of the tax. If you are a renter, fees will include the costs of production, meaning that they will reduce the tax base.

Useful advice

When transferring a fixed asset in a lease, it must be stored and the inventory number. The tenant must make a note of the rental on the card. In the inventory, these objects are taken into account.