You will need

- For accounting or reporting forms, Ledger balance on the values of the accounts.

Instruction

1

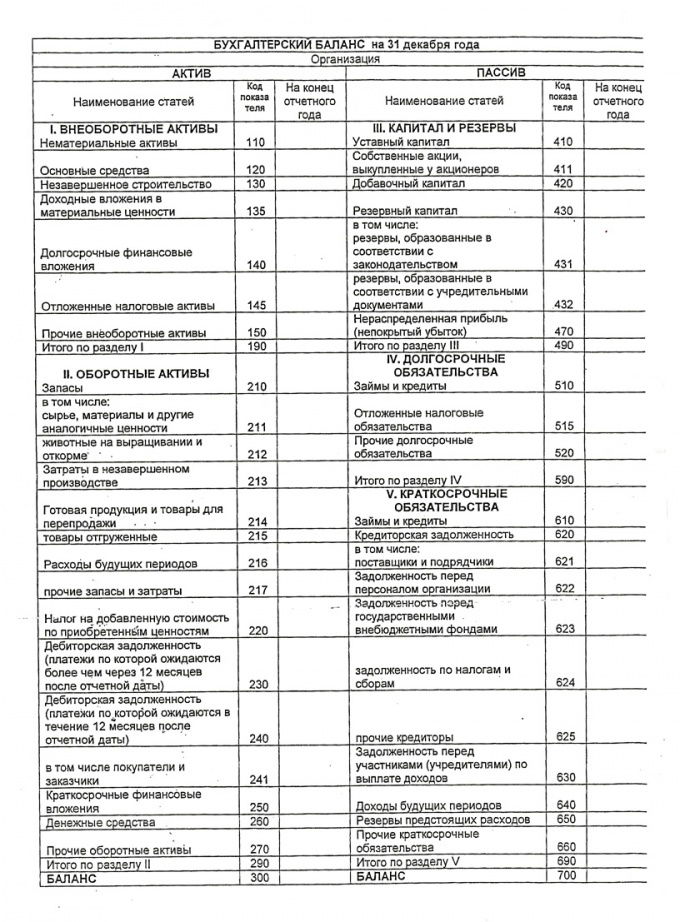

Fill out the top of form 1, or enter data into computer accounting software.

2

Complete the first section of the asset – non-current assets. Are included here: major funds that can be invested in the construction, completed or not, in the material values of various assets. This information is entered in the corresponding lines of the finished form of balance.

3

Complete the second section of the asset – current assets. This takes into account: different stocks of the enterprise, the VAT amount is still not accepted to a deduction, accounts receivable, investment companies, invested for a short period, the availability of Finance and other assets.

4

Complete the third section liabilities – capital and reserves. This takes into account such types of capital as equity and incremental. Specify the details of the reserve capital, for example, reserved for future planned expenditures. This paragraph should also specify the retained earnings.

5

Complete the fourth section of the liabilities – long-term obligations. This takes into account: long-term loans, such as loans. At this stage, you specify the obligations to the tax that was deferred for a number of reasons, as well as other liabilities on behalf of the company.

6

Complete the fifth section liabilities – short-term obligations. This takes into account: loans and loans taken for a short term debt on such debt to the founders. Entered to balance the projected revenues and expenses and the Finance that is earmarked for them. Be sure to specify and liabilities.

Note

The balance is considered to be reduced when the total amount of assets is fully consistent with the total liabilities.

Useful advice

The easiest way for drawing up a balance to use specialized accounting software.