You will need

- - Internet;

- - appeal to the customs;

Instruction

1

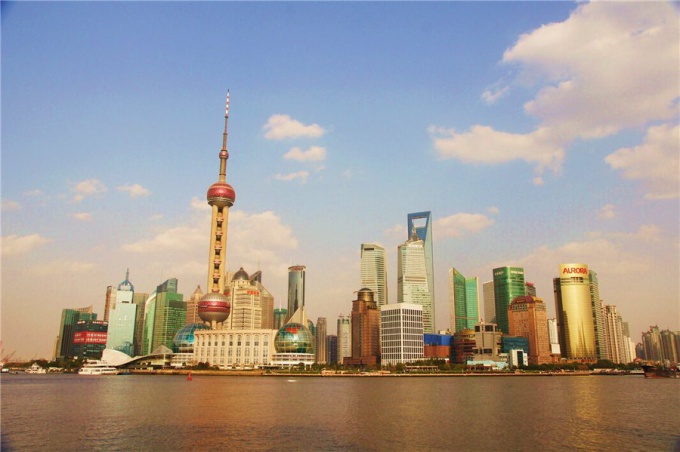

If you need to purchase product for personal use within the baggage allowance, China will not disappoint you. Today, many products of this country are no longer associated with consumer goods. Go to Shanghai or city in the South, such as Guangzhou. Any guide will help you to get an idea of the largest shopping centres in these cities. Offer in the consumer goods sector, without exaggeration, surpasses. It is not necessary to go shopping in Beijing or in North Eastern province (e.g. Manchuria). These areas are considered "commercial Paradise", but the average buyer is unlikely to appreciate the prices or range of products.

2

To buy the goods for commercial use, you need to find a manufacturer or supplier. Not all Chinese factories are licensed to export, so in 70% of cases you will be dealing with export intermediary company. To find their own agent at the exhibitions or via the Internet using large resources, for example, made-in-china.com or exports.cn. On such sites you can find direct contacts of intermediaries and manufacturers of any goods, contact them and discuss all conditions of cooperation.

3

Turning to the customs, register your company as a participant of foreign economic activity. If you are an individual, sign a contract with the Department of services for individuals. Provide a detailed description of the items you plan to purchase. The customs broker will guide you on the amount of duties and taxes that you will have to pay. Try to carry out customs clearance of goods, as he will be in the way.

4

Once you sign a contract with a Chinese supplier, find a transport company. Her representative should communicate with the Chinese side to negotiate the date and terms of delivery. Do not contact the Chinese transport company, even if services will be cheaper. It is better to deal with Russian officials, the contract with which will guarantee legal protection of your trade at the time of delivery.

5

After the goods will be shipped, provide the customs broker copies of the following documents:

1. Contract and specifications

2. Invoice

3. Technical product description

4. The passport of the transaction issued by the Bank

5. Contract and invoice from the transport company

6. Certificate of origin

7. Export Declaration in the Chinese language.

8. Transport nakednesse you make purchases from individuals, the import duty will be calculated on the basis of customs. As a rule, in this case the customs value of goods will be very high. That is why it is advisable when you purchase goods in China to have all of the above documents.

1. Contract and specifications

2. Invoice

3. Technical product description

4. The passport of the transaction issued by the Bank

5. Contract and invoice from the transport company

6. Certificate of origin

7. Export Declaration in the Chinese language.

8. Transport nakednesse you make purchases from individuals, the import duty will be calculated on the basis of customs. As a rule, in this case the customs value of goods will be very high. That is why it is advisable when you purchase goods in China to have all of the above documents.

Note

If you purchase a product for commercial use in Hong Kong, keep in mind that it will be subject to double customs duty. Send a cargo transport company, registered in China.

Useful advice

In any procurement in China it is necessary to bargain. To get a significant discount, even if the price tag is a fixed price.