You will need

- • The certificate on statement on the account in tax authority (INN);

- • Access to the Internet;

- • The printer.

Instruction

1

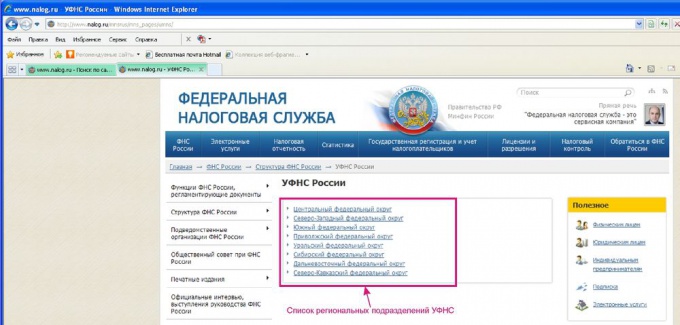

To find out how much tax you have to pay for you own an apartment, review the rates of tax on the website of the regional Department of the Tax service of the Russian Federation. This can be done by visiting the Official website of the Tax service of the Russian Federation http://www.nalog.ru/mnsrus/mns_pages/umns/.Ставки tax are set annually by the regulatory legal acts of representative bodies of local self-government.

2

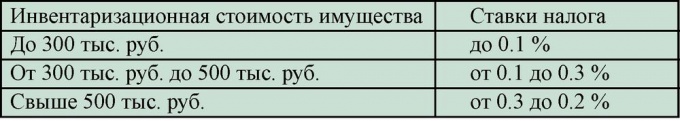

The taxable base is the inventory value of your apartment. There are certain law limits the rates of property tax.

3

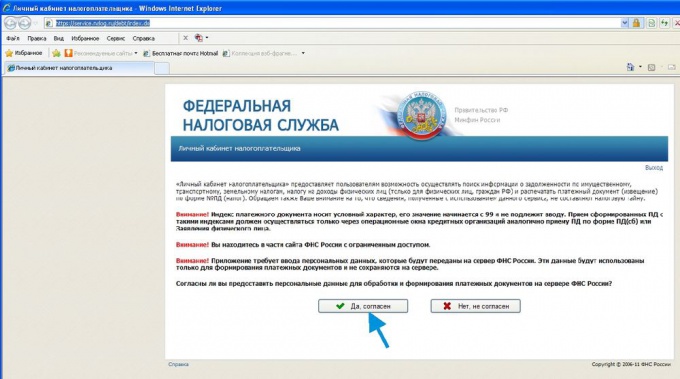

Often happens that we receive in the mail a notice from the tax office calculation of the amount of tax on the property with the attached receipt for the payment. The receipt can to pay in cash Desk of banks, remitting taxes of physical persons in the local budget. The payment notice on payment of property tax must be received by e-mail no later than August 1 of each year. If for some reason the notification does not reach or disappears from the box, you must contact the tax office at the place of registration of the property for obtaining a receipt for payment of the tax. To rid yourself of long standing in queues for the receipt in tax, you can use the relatively new service the Federal Tax service of the Russian Federation, which is called the "taxpayer's Personal account". To visit it you can at the following link: https://service.nalog.ru/debt/ . Do not forget that to use this service, you will need to enter your taxpayer identification number.

4

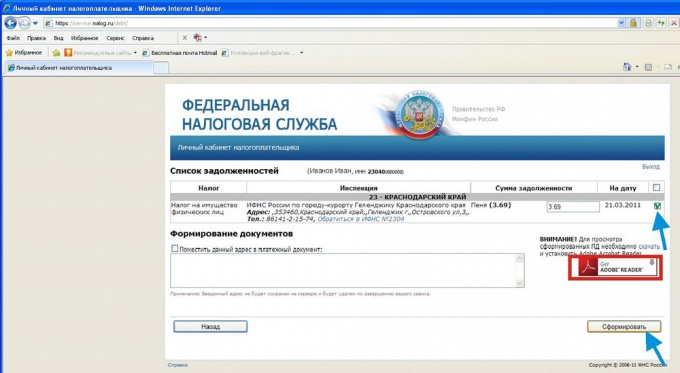

After filling in all required fields and processing of your personal information the result is a table with a list of your debts at the taxm, where you will find the tax on property (the apartment). For the receipt check at the end of the rows and click "Create". A receipt in PDF format will open in the appropriate program from which you can print to the printer. A receipt can be paid in the Bank accepting such payments.

Note

Payment of property tax, you, as the owner, should produce equal shares in two terms — not later than 15 September and 15 November. For late payment of tax you will be charged a penalty equal to 1/300 part of the refinancing rate of the CBR.

Useful advice

If you have a credit / debit card you can make a tax payment for the apartment through an ATM. You can also use the payment terminal with enhanced functionality that take local tax payments.