You will need

- Internet

- Bankowosci account

- A PayPal account

Instruction

1

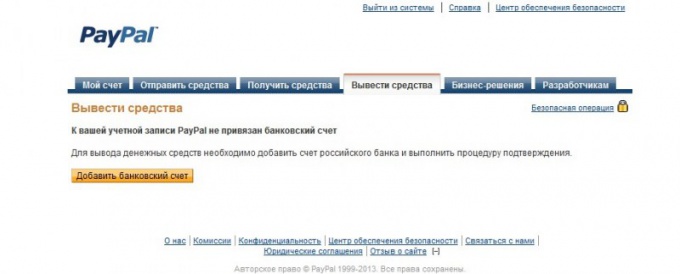

To bind your Bank account to your paypal account go to your account tab to withdraw funds. There you will see (of course, if the account has not yet assigned) notification that the account is not yet linked and click "Add Bank account". Clicking on this button will take you to the first step of the binding account.

2

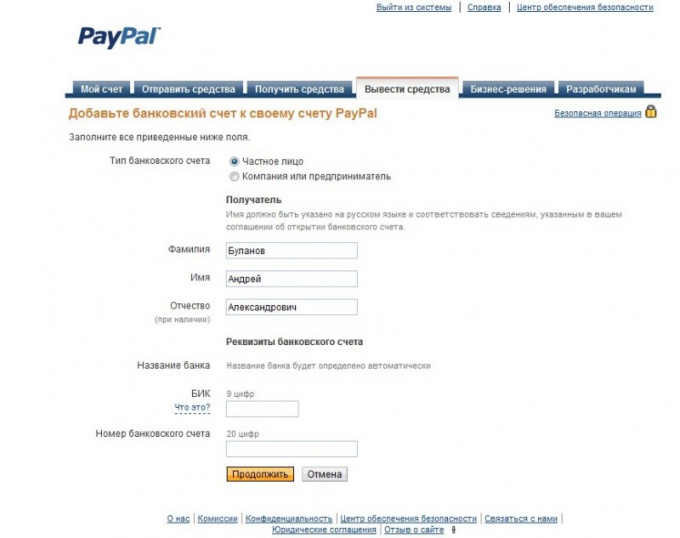

In the first field "Bank account type" you must specify which account you link. By default, it selected "the Company or entrepreneur", but remember that if you choose this item, you will be prompted to enter the INN and then with each transaction you will be charged tax at the tax office. Therefore it is better to choose "Private person". Here the collection of taxes does not occur. About the name will not speak, everything is clear. You will be required to indicate the BIC of the Bank. You can find on the official website of the Bank in its details. Well, the Bank account number. And click "Continue".

3

Next you will be asked to double-check the details, if everything is in order, click "Continue".

4

On the next page you will see a message that Paypal sent to your account for two amounts, the number of which you have to know your Bank and enter them on the form. No need to run to the Bank and find out. The amount usually only come in 2-3 days. Once you find out the exact amount of the transfer, re-open your Paypal account, select "withdraw funds", you will be asked to confirm the Bank account number. Clicking the button takes you to the page input of the two transfer amounts. Enter these amounts and click the send button.

5

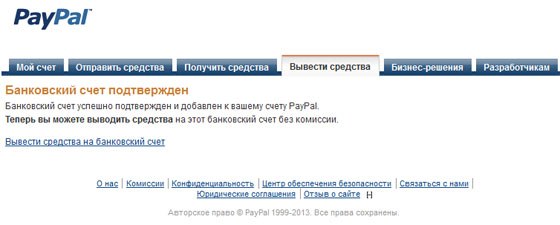

If done correctly, you will see a notification that your Bank account is confirmed. Now you can withdraw funds to your Bank account by clicking on the appropriate link.

Note

If you start a company, calculations which you intend to pay via PayPal "Type of account" it is better to specify as a Company and not a private person and honestly pay taxes, because the refusal to pay taxes is a criminal offence.