Instruction

1

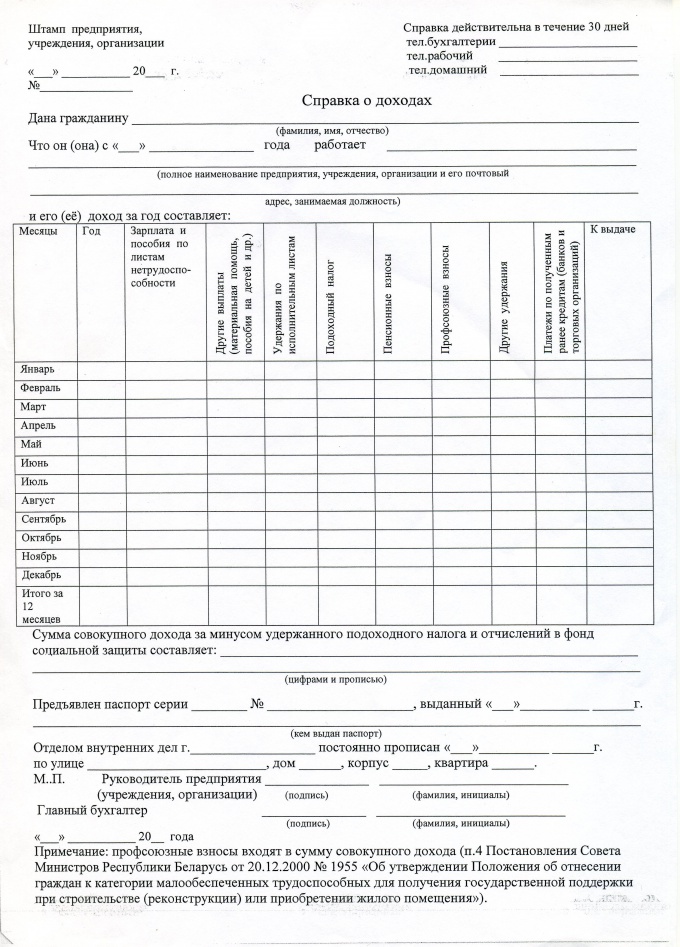

To complete a certificate 2-pit the duty of the person responsible for the accounting of income and deduction of taxes, that is, the chief accountant of the enterprise or a Vice. Signs the document head. Be sure affixed the seal of the organization and shall include all information INN, who give help and organization, which certificate has been issued.

2

Information about the income filled in for 6 or 12 months depending on what is required to the employee. The same period is indicated in the calculation of tax assessments.

3

Amounts are written in precise, not abbreviated.

4

Filled with accurate information about the employee and the organization issuing the certificate.

5

If an employee works for several employers, then fill out the form 2-NDFL is required every employer.

6

If the income is not official, and tax contributions from income are not paid, the employer refuses to fill out an official form of certificate of income. In this case banks issue their own forms to fill out.

7

Income reported for a period of 6-12 months. The amount remaining after tax.

8

Written all the details of the recipient of help and the organization issuing the certificate.

9

Also indicated was an employee and was of the organization. Put the seal of the organization issued the certificate, the resolution of the head and the chief accountant of the enterprise.

10

Currently, the media is overflowing with announcements of assistance in obtaining certificates of income.

11

For the fake certificates submitted in any court, the bearer faces an administrative fine. Besides, don't forget, if you are going to receive a loan with a fraudulent certificate, the security service of the Bank first verifies the validity of the information submitted by the borrower and only after that comes the decision, will issue you a credit or refuse.