Instruction

1

In case of loss of certificate of tax can be recovered. It is necessary to contact tax body at the place of issuance of the previous certificate or to another place of residence, taking with him the identity document with the indication of registration to this address. You should write a statement about the loss of documents by a special pattern that is filled very carefully and accurately. In addition to the passport data in the application form necessarily fit the exact address of the place of residence and index date and the last registration. In a certain column be useful to include information about what the certificate on assignment of individual number was lost.

2

It is important to know what to restore the lost INN need to provide a receipt for payment of this service tax service. The fact that this document is issued free of charge. But for the re-design of the certificate was required to pay 200 rubles. In cases that require the urgent restoration of the certificate provides for the payment of 400 rubles. The results of the new instrument was made before the expiry of 5 working days from the date of application.

3

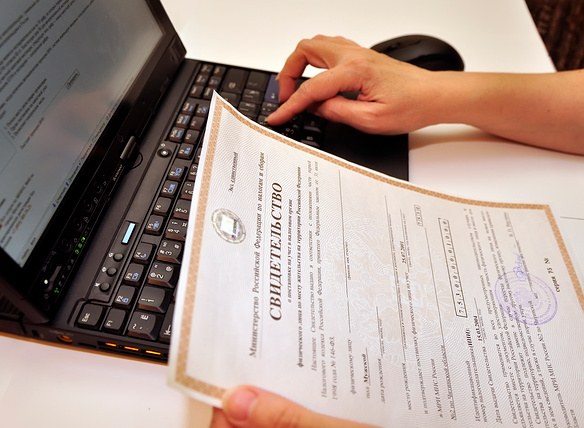

Currently, the particular popularity of the new online service, which is organized by Federal tax service (FNS) to improve the quality of service of taxpayers. Now, individuals who have lost their certificate of taxpayer identification number may obtain information through the Internet. To do this, go to the official service FNS of the Russian Federation and fill all the required fields with the indication of surname, name, patronymic and passport data.

4

How to restore the certificate with a unique number over the Internet is no different from the virtual. Required to fill the online application form, indicating all personal data, including leave contact information for follow-up. Once a new document was ready, the IRS is required to inform the applicant about it and say when and where it can be taken away.