Instruction

1

First, look at what rate you will recover the VAT. It must be restored at the same rate at which it was deductible. If you acquired the asset before 2004, when the rate was 20%, then you have to use the same 20%. And this is despite the fact that currently such a rate does not exist. However, in the Tax law for this reason explanation there.

2

Having placed your bet, calculate VAT on fixed assets and intangible assets. Please note that you will have to restore not the whole deducting the value added tax, but only a part, proportional to residual value.

3

Next, decide the VAT on the remaining goods and materials. Their cost rate, multiply by the VAT. The resulting amount of pay in the budget.

4

The restored VAT enter in the sales book and purchase book do not touch. And you have to pay this VAT on the basis of the invoice on which this tax was accepted for deduction. This is evidenced by the letter №03-04-09/22 of the Ministry of Finance dated 16 November 2006.

5

The amount restored and paid VAT to consider as expenses for calculating profit tax. And - it costs the tax period that precedes the period when you went to the USN. If you are an entrepreneur, reduce the basis for calculating personal income tax, again for the previous period.

6

Don't forget about accounting and tax accounting. The restored VAT take, as mentioned above, the other costs.

Of course, recovery of the VAT will require you a lot of time and effort. But this procedure is spelled out in the tax legislation, and to avoid it, unfortunately, impossible.

Good luck with the business!

Of course, recovery of the VAT will require you a lot of time and effort. But this procedure is spelled out in the tax legislation, and to avoid it, unfortunately, impossible.

Good luck with the business!

Note

Recovery of VAT during the transition to the USN. Although all the media declared support of small and average business, the tax authorities are making numerous efforts to infringement of interests of small business and use standards to support entrepreneurs. In particular, the tax authorities believe that the transition to the simplified system of taxation should recover all VAT previously accepted for deduction.

Useful advice

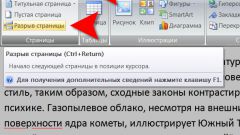

Recovery of VAT during the transition to the USN. This is perhaps the most painful question, and it applies to both businesses and individual entrepreneurs. The fact that under paragraphs 2 and 3 of article 346.11 of NK of the Russian Federation "simplified" are not subject to VAT. What kind of book to write? Since all business transactions are accompanied by the documents and decide which document to reflect restored in the transition to the "simplified taxation" of the VAT. Accrued and credited VAT is indicated accordingly in the books of sales and purchases.