You will need

- - tax and other documents;

- - automated program.

Instruction

1

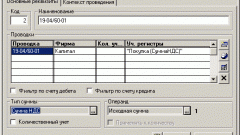

Accounting of goods includes several stages: receipt or manufacture, movement and sale. Each stage documented. To simplify accounting, it is advisable to use automated programs such as "1C: Trade and warehouse".

2

Be sure to assign responsible persons for products. This may be one person, and maybe several. For example, you have your own production. In the shop must be the head of supervising staff and performance, including quality. Regularly it needs to be accountable to you, to submit accounting documents. It is also necessary to assign material responsible for storing goods in the warehouse. This person should receive the documents on the transfer of goods and to make goods for sale.

3

If you acquire products from third parties, enter into with counterparties of the contract of sale and execute supporting documents. For example, an employee needs to obtain the goods from the warehouse of the supplier. Write down the name of the worker power of attorney for property (form # 2). He needs to accept the goods, to check the availability and the quality of the products. If everything is OK, sign the invoice and bill of lading. If there are deviations, you have to be drawn up.

4

After receiving all documents, we will process the transaction in the accounting records. To check the correctness of filling forms check amount. Enter the invoice in the purchase Ledger. Surrendered to the flow of goods using the transaction:

- Д41 K60 – include the receipt of goods;

- D19 K60 – reflects the amount of input VAT;

- Д41 K42 – reflects a margin on the goods.

- Д41 K60 – include the receipt of goods;

- D19 K60 – reflects the amount of input VAT;

- Д41 K42 – reflects a margin on the goods.

5

When selling goods you must issue the following documents: invoice, consignment note (waybill) and invoice. Tax document, make two copies, register it in the sales book. Waybill will be issued in four copies. In the accounting records reflect these transactions as follows:

- D50 К90 – reflected the revenue for the goods sold;

- D90 K68 – reflects the accrual of VAT;

- D90 K41 – reflected write-off the cost of goods sold;

- D90 K42 – reflected write-off of trading margins.

- D50 К90 – reflected the revenue for the goods sold;

- D90 K68 – reflects the accrual of VAT;

- D90 K41 – reflected write-off the cost of goods sold;

- D90 K42 – reflected write-off of trading margins.