You will need

- A computer connected to the Internet, printer, flash drive, CD or other storage device, pen, passport

Instruction

1

First decide what sample you need a passport. This depends on the size of the state fee. There are two types of foreign passports. Biometric, or a new sample, which is issued for 10 years. The state duty for receipt for an adult is $ 2500 for a child up to 14 years – 1200 R. the Second option is foreign passports – old paper. It is issued for 5 years, stamp duty for adult and child up to 14 years, equal to 1,000 p. and 300 p., respectively.

2

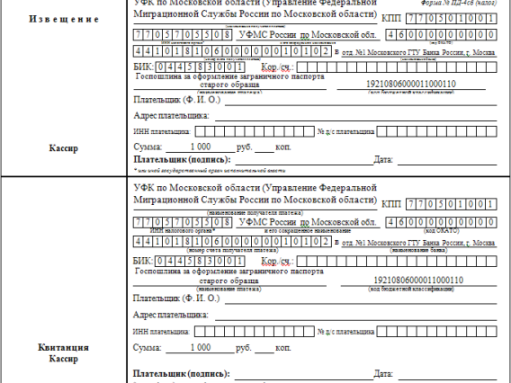

Look through the Internet on the website of the Federal migration service your area or other organizations that facilitate the obtaining of passports, the service receipt about payment of state duty. Form receipt. Pay attention to the details of the payee. It is extremely important to specify them correctly. Print the receipt on the printer. The payment document is ready.

3

If there is no printer, search the Internet ready form of state duty. Be sure to check the correctness of the mentioned details of the units of the Federal migration service, where they will receive a passport. Download the form on a flash drive or other storage device. Go to any copy center, print out the form. Write in it by hand your details (surname, name, patronymic, address of registration) and a receipt is ready for payment.

4

In the absence of a computer, take payment form the registration fee in the regional office of the Federal migration service of Russia. If necessary, find out there details – Bank name, account number, BIK, INN, KPP. By hand, carefully and accurately enter all necessary data. Complete data on the payer. Pay the state duty on international passport in any branch of Sberbank of Russia. Or go to the nearest branch of the savings Bank of the Russian Federation. Give the passport to the employee of the financial institution, and he in a matter of minutes, will issue a receipt of state duty on international passport. This service is free, it is important to know what amount to pay.

Useful advice

Receipt of payment of registration fee is valid for three years from the date of payment, provided that during this time is not changed, the amount of paid state duty.