You will need

- Internet

- Inn

Instruction

1

Go to the website of the Federal tax service of the Russian Federation located at the address http://www.nalog.ru/. In the upper left of the main page select the tab "E-services" and select in the menu the section "Personal Cabinet of the taxpayer", especially designed for personal information on accrued tax payments and existing debts.

2

In the next window you will be asked to give consent or to refuse to provide personal data that will be used to search in the system of personified registration of information and creation of payment documents. Confirm willingness to provide their personal details by clicking "I Agree".

3

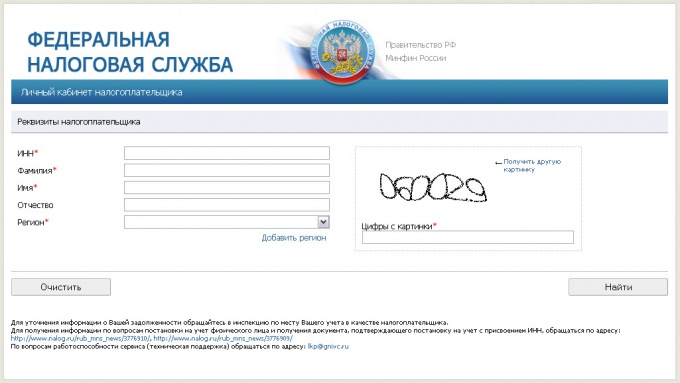

In the active field, enter your taxpayer identification number (TIN), surname, name and patronymic ( the latter is not required). The region will be automatically selected by the system from the database on the basis of VAT, provided for filling in the boxes in order. But it is possible to select the region manually from the drop down menu in the appropriate row. Now very carefully copy in the box the numbers you see, the system verifies that your computer's settings according to your requirements. Click "find" to select the appropriate files.

4

In the opened window you will see a list of your debts for taxes or a clear space, indicating a lack thereof. Each separate line will be the tax details of the tax inspection (with the possibility of instant communication via e-mail to resolve disputes) and payment amount. Here you will be able to print a receipt in the prescribed form, already filled in details, for the payment of the tax in the Bank.

Note

To quickly jump to "taxpayer's office" you can use the link with its address specified at the end of the article.

Useful advice

For information regarding the regulatory framework for the formation of tax payments for individuals you can go to a special section of the site. In the upper left of the main page, select "individuals" and go to the section specifically designed to inform citizens about news and changes in tax laws, allocation of regulatory material and documents.