Instruction

1

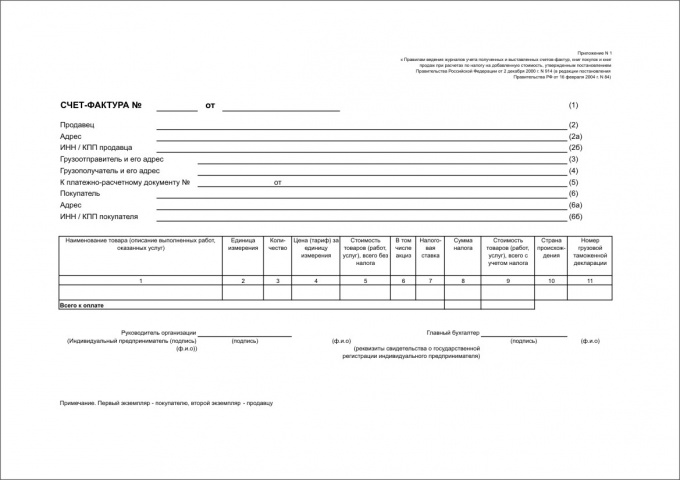

Invoices are prepared only by the taxpayers. Firms not paying VAT, to fill in invoices is not necessary. If the VAT is zero, the invoice is still prepared indicating 0% VAT in the appropriate box.

2

The invoice is filled in 2 copies and billed to the buyer within 5 days, excluding day of shipment (performance of works, rendering of services).

3

In one instance the invoice is made by the taxpayer in the case of receiving from the buyer the payment or partial payment, execute, own construction works, the gratuitous transfer of property, obtaining financial assistance, the emergence of positive value differences.

4

Allowed statement invoices combined method – using the computer and by hand.

Registration of invoices is made in chronological order from the beginning of the year.

The amounts in the invoices are usually listed in rubles, although allowed to reflect payments in foreign currency and conventional units. In this case, the course of recalculation must be reflected in the contract between the buyer and the supplier.

Registration of invoices is made in chronological order from the beginning of the year.

The amounts in the invoices are usually listed in rubles, although allowed to reflect payments in foreign currency and conventional units. In this case, the course of recalculation must be reflected in the contract between the buyer and the supplier.

5

According to the Rules of maintaining registers of invoices, filled in the invoice as follows. Line 1 – serial number and date of issuance of the invoice.

Line 2 – name of the seller in accordance with the constituent documents.

Line 2A – location of the seller according to constituent documents

Line 2B – the INN and KPP of the taxpayer-seller. If the sale is carried out by the branch, the indicated transmission branch.

Line 2 – name of the seller in accordance with the constituent documents.

Line 2A – location of the seller according to constituent documents

Line 2B – the INN and KPP of the taxpayer-seller. If the sale is carried out by the branch, the indicated transmission branch.

6

Line 3 – mailing address of the shipper. If the seller and the consignor are the same person, this line is written "he". When performing work or rendering services in the line put a dash.

Line 4 – name of consignee (buyer)in accordance with the constituent documents and its mailing address or the name and address of the branch if the shipment of goods to a separate entity.

Line 5 – number and date of drawing up of Bank payment order or cash receipt attached to the invoice and for which an advance payment received for goods, works or services. Otherwise, put a dash.

Line 4 – name of consignee (buyer)in accordance with the constituent documents and its mailing address or the name and address of the branch if the shipment of goods to a separate entity.

Line 5 – number and date of drawing up of Bank payment order or cash receipt attached to the invoice and for which an advance payment received for goods, works or services. Otherwise, put a dash.

7

Line 6 – the name of the buyer in accordance with the constituent documents.

Line 6A – its location according to the constituent documents.

Line 6b – of the INN and KPP of the buyer-the taxpayer.

Line 6A – its location according to the constituent documents.

Line 6b – of the INN and KPP of the buyer-the taxpayer.

8

In column 1 – the name of shipped goods, executed works or rendered services.

In column 2 – the unit of measurement of the goods (in other cases – if possible to specify)

In column 3, the total quantity of goods, works or services according to the unit of measurement.

In column 4 – the product price per unit without VAT. In the case of state-controlled prices, including the amount of tax – VAT.

In column 5 – the total amount for goods, works or services without VAT. If one invoice is several different items, this column is not populated.

In column 2 – the unit of measurement of the goods (in other cases – if possible to specify)

In column 3, the total quantity of goods, works or services according to the unit of measurement.

In column 4 – the product price per unit without VAT. In the case of state-controlled prices, including the amount of tax – VAT.

In column 5 – the total amount for goods, works or services without VAT. If one invoice is several different items, this column is not populated.

9

In column 6 – sum of excise tax on excisable goods or not filled.

In the graph a 7% tax rate

In column 8 – the VAT amount offered to the buyer in accordance with the tax rate.

Column 10 – total amount for goods, works or services with VAT

In the graph 11 – the number of the customs Declaration. Affixed at implementation of import operations. If Russian goods, in the column put a dash.

In the graph a 7% tax rate

In column 8 – the VAT amount offered to the buyer in accordance with the tax rate.

Column 10 – total amount for goods, works or services with VAT

In the graph 11 – the number of the customs Declaration. Affixed at implementation of import operations. If Russian goods, in the column put a dash.

10

The invoice shall be signed by the Director and the chief accountant of firm-the seller with a required signature. In the absence of such signature, and the signature is made by persons having the power of attorney from the organization and appointed order.