You will need

- - computer with Internet access;

- - certificate of income on form 2-NDFL for last year;

- - the passport and the INN certificate;

- - certificate of state registration of ownership of the apartment (house);

- - copies of payment documents confirming expenses on the acquisition of property;

- - the documents confirming the payment of percent on the target credit agreement or loan agreement, mortgage agreement.

Instruction

1

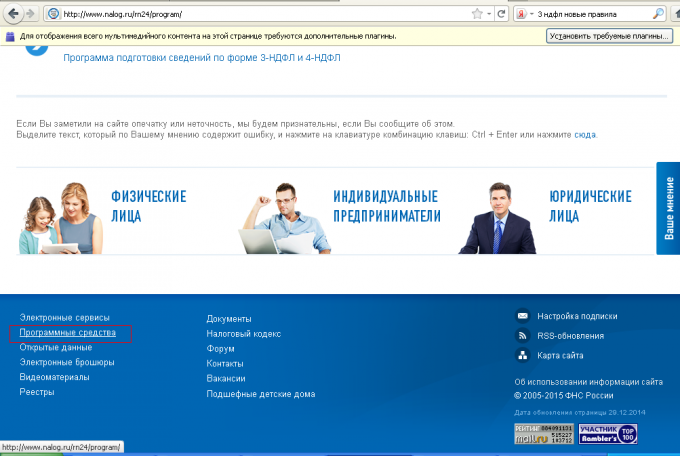

Download and install the program "Declaration 2014" from the official website of the tax service of Russia. You can find her with the section "Software tools" at the bottom of homepage.

2

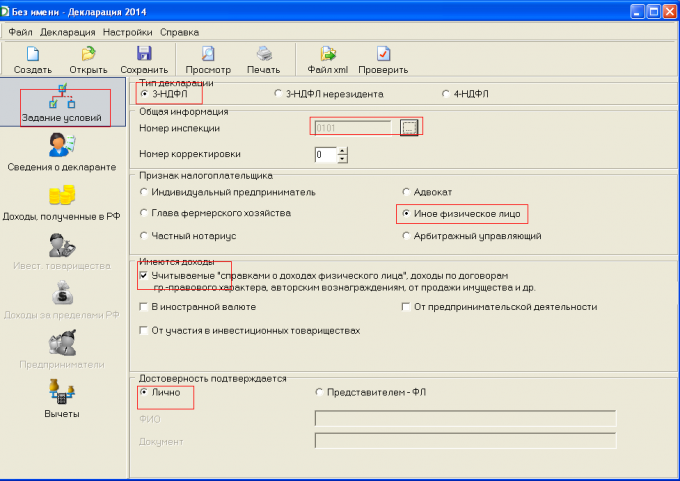

Run the program. The program opens the tab "setting conditions". Note the required values.

3

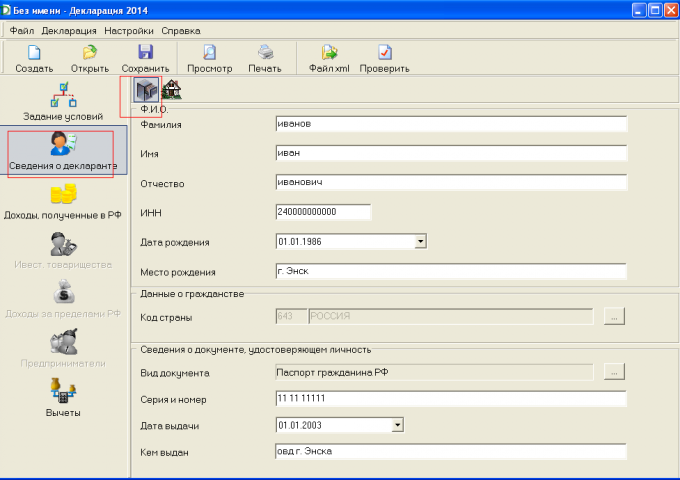

Go to the tab "details of the declarant". Fill in the passport data.

4

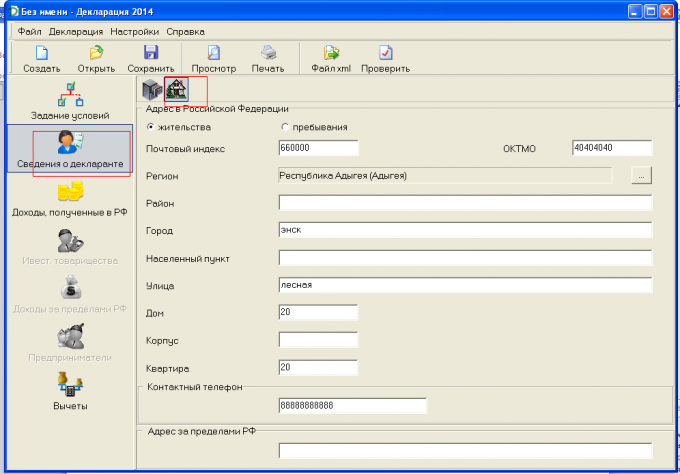

In the same tab, click on the icon "house" and filled the place of residence according to passport. Don't forget to specify a code OKTMO (you can find the website of the FMS of Russia, via the "Know OCTM").

5

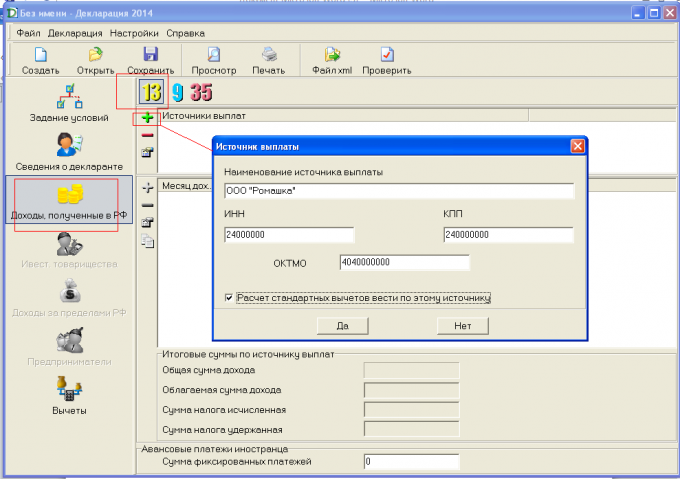

Go to the tab "Income earned in the Russian Federation". In the table "Sources of payments" click on the "+" icon and fill in information about your employer (information taken from reference 2 personal income tax). If employers are several, add them by clicking on the "+"icon.

6

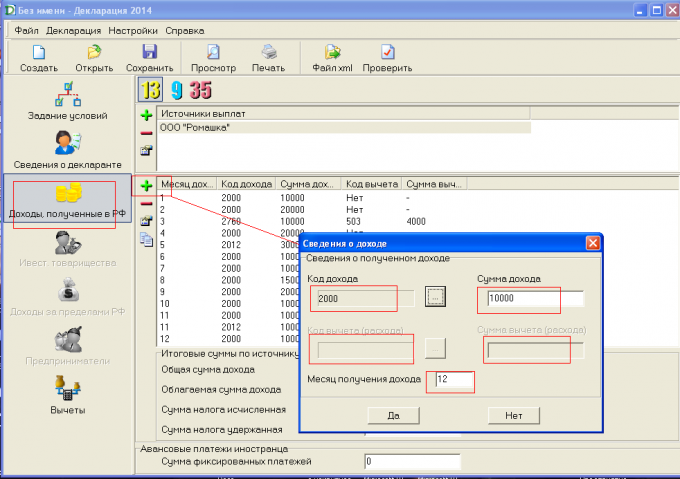

Similarly, fill in the table with the information about income. Click on the "+" and make the data of reference 2-personal income tax: income code amount of income deduction code (if any), the amount of the deduction (if any) for each month separately. Each line with an income in your letter, a separate column in the table of income Declaration. If in one month you in help 2-NDFL several amounts (for example, the salary and financial assistance, and holiday pay) each amount is entered separately.

7

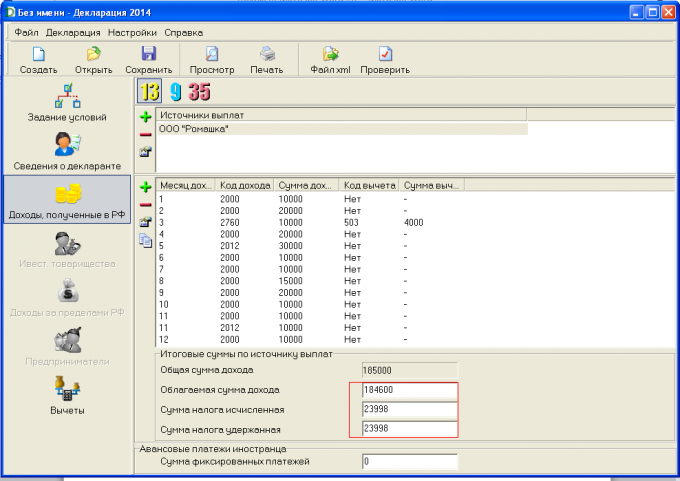

After filling in the table data on incomes at the bottom of the column. The total amount of income will be automatically calculated taxable income amount, the tax amount calculated and the amount of tax withheld is made independently of the reference 2-pit.

8

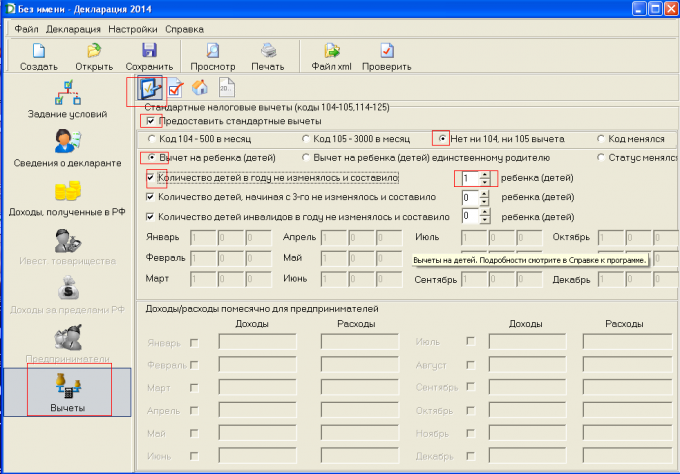

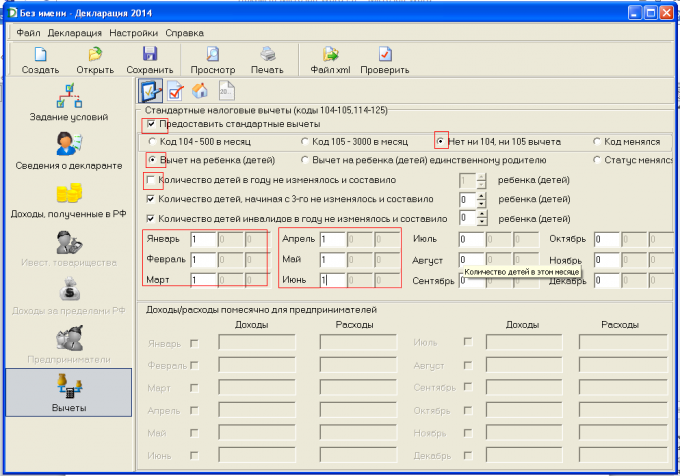

Go to the tab "Deductions". If you receive standard tax deductions, put a tick in the appropriate box. Deductions are also recorded in your certificate 2-pit. Placing necessary values.

9

In a situation when the deduction was granted the entire year (for example, a child graduated at the Institute in June), remove the check mark from the corresponding box and stamped values in those months when the deduction was granted.

10

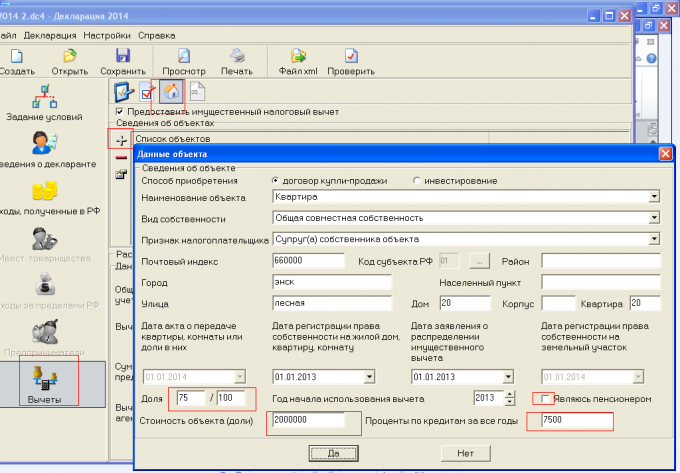

In the same tab, click on the icon "house". The program offers to fill in information about objects. Click on the "+" icon and fill in the necessary information. Note on the distribution of the shares. Spouse, if the house is in their joint ownership, have the right to apportion the deduction in any ratio, the value of the object when it is spelled full and the interest amount to the fraction. That is, if the cost of housing is 2 000 000 (this is the maximum which can be returned to personal income tax), interest for all the years 10 000, and the share of the spouse is determined 75 %, the count value of the object we are writing 2 000 000, and the interest in the box 7500.

If you get the deduction in 2014, that is, the documents confirming the right to reception of a property tax deduction, dated as of 1 January 2014, the window "share" will not be active and fill it is not necessary (then count in the cost of housing to be filled according to the size of the share).

If you get the deduction in 2014, that is, the documents confirming the right to reception of a property tax deduction, dated as of 1 January 2014, the window "share" will not be active and fill it is not necessary (then count in the cost of housing to be filled according to the size of the share).

11

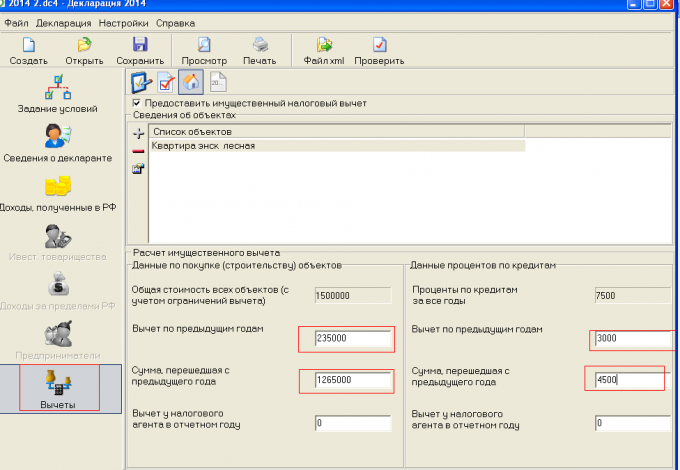

In the same tab, fill in the amounts already received deductions in the past years. If you use less you started with 2014, the Windows to fill in the amounts for previous years are not active. If the deduction get, for example, as in the example since 2013 then you need to fill in the proper sections: the deduction for previous years (write in the amount, which was estimated personal income tax last year); the amount transferred from the previous year (you can view the Declaration last year, and you can subtract from the total amount in the example 1, 500, 000. the amount was deducted income tax last year); the deduction for previous years and the amount transferred from the previous year in terms of interest (also looking to how much was provided in a previous Declaration.

12

Stored, viewed, check, print. Sign and provide the IRS with documents: the application for refund of personal income tax with the indication of requisites for transfer of the sums of return, a certificate from the accounts Department under the form 2-NDFL for the relevant year, copies of the documents confirming the right to housing, copies of payment documents confirming expenses on the acquisition of property, the documents confirming the payment of percent on the target credit agreement or loan agreement, mortgage agreement, copy of marriage certificate (if housing is purchased in joint ownership), statement of distribution of property tax deduction (if housing is purchased in joint ownership).

Note

If housing acquired before 1 January 2014, the deduction is limited to the amount of 2 000 000 in respect of a property if the housing is acquired after January 1, 2014, the limitation is not "bound" to the object, as applies to every citizen.

Useful advice

Not so important what letters you fill in fields in the Declaration the program will automatically convert them to uppercase.

Keep copies of all handed in tax declarations, for ease of preparation later.

Keep copies of all handed in tax declarations, for ease of preparation later.