Instruction

1

According to the theory of Keynes, an increase in investment triggers the multiplier process, which is reflected in the increase in national income by a greater amount than the original increase in investment. This effect Keynes called the effect of the multiplier. k (multiplier) = growth income / growth investments. Marginal propensity to savings and consumption depends on the strength of the effect of the multiplier. If the values of these parameters relatively constant, to determine the multiplier is not difficult.

2

To calculate the multiplier, assume that:

I – investments; C – consumption; Y – national income; the MPS is the marginal propensity to save and MPC is the marginal propensity to consume.

I – investments; C – consumption; Y – national income; the MPS is the marginal propensity to save and MPC is the marginal propensity to consume.

3

Since Y = C + I, the increase in income(Y) will be equal, respectively, to the amount of growth of consumption(C) and investment growth(I).

4

According to the formula, the marginal propensity to consume: MPC = C / Y, we get: C = Y * Mrs.

Substitute this expression into the equation above (Y = C + I).

Will get: Y = Y * MPC + I.

Hence: Y * (1 - MPC) = I.

Substitute this expression into the equation above (Y = C + I).

Will get: Y = Y * MPC + I.

Hence: Y * (1 - MPC) = I.

5

Next: the increase of income Y = (1 / 1 – MPS) * a rate of investment I, but since k = increase in Y / increase I, therefore gain Y = k * increment I. This means that k = 1 / 1 – MPS = 1 / MPS where k is the multiplier of the investment.

6

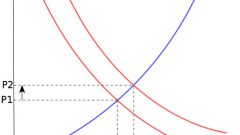

Thus, the multiplier of investment is the reciprocal of the relative to the marginal propensity to save. The multiplier operates in both forward and back.

Useful advice

Investment multiplier reflects the positive impact of the investment on other sectors. John.M. Keynes his theory offered in addition to the investment to adjust the national income by raising taxes, for the withdrawal of savings in order to increase the investment of the state.

The multiplier effect can be caused not only by the increase of investment and other components of Autonomous expenditure (total spending). Then talking about the multiplier of total expenditures; it also operates in the reverse direction.

The multiplier effect can be caused not only by the increase of investment and other components of Autonomous expenditure (total spending). Then talking about the multiplier of total expenditures; it also operates in the reverse direction.