You will need

- - balance sheet

Instruction

1

Calculate the balance profit of the enterprise. Balance sheet profit is calculated as the difference between the company's income from operating activities and expenditures of the company for these transactions. The income of the enterprise can be divided into two groups: realizable and non-operating. The first group includes revenues from the sale of products or services, fixed assets (including land) and other assets. Non-operating income includes income from renting of property income from stocks, bonds, Bank deposits.

2

Calculate the average annual value of fixed assets of the company. Fixed assets is material assets involved in production, and in the process wear transfer their value to the manufactured products. The average annual value of fixed assets is determined as follows: need to add half the cost at the beginning and end of the year, the full value of fixed assets at the beginning of all months of the year and the amount received divided by 12.

3

Determine the average annual cost of working capital. Working capital is the funds that the company uses in its production-economic activities. The average annual cost of working capital can determine the folding of the average annual value of inventories, WIP, semi-finished products of own production and expenditure in future periods. Data for calculation can be found in the company's balance sheet during the reporting period.

4

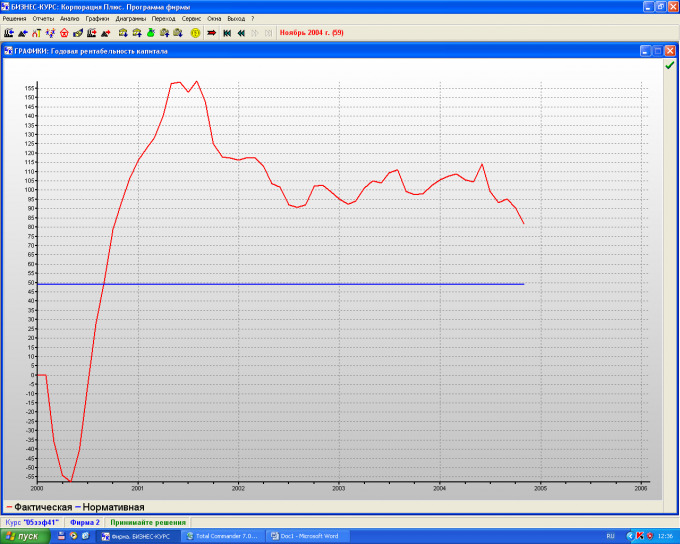

Calculate the profitability of production. Profitability is calculated as the quotient of the balance sheet profit of the enterprise for the sum of the average annual value of fixed assets and average annual cost of current assets.