You will need

- calculator;

- -knowledge of financial management

Instruction

1

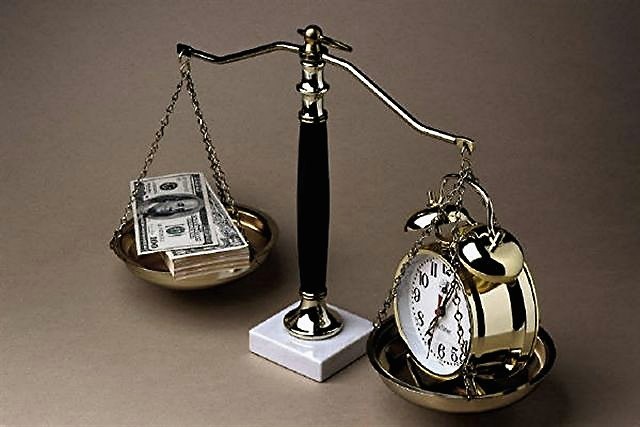

The coefficient of discounting is directly connected with the factors of time and income. It is an indicator reflecting the ratio of future income to their current present value. This ratio helps to determine what should be the percentage increase of income to get the desired result in the future. Allows to predict the dynamics of cash flows.

2

This economic indicator is used in all financial sectors. It is used to determine the economic efficiency of the project or activity specific to your organization. Calculation of cost of capital and cost in business plans is also not complete without this factor. It compares alternative options, determine which is the least costly part of the supply and use of funds.

3

The formula of calculation is as follows: kd=1/(1+d)^nd = rate of discount or discount rate;n = time or number of periods during which you plan to receive the income.

4

Rate discounting is the main constituent element of factor of discounting. It represents the cost of capital. Expected return an investor is willing to invest in this project. Rate discount variable quantity, it is impacted by numerous factors. In each considered case they are different.

5

When calculating the rate can be used the following options: the rate of inflation, the profitability of the alternative project, the cost of credit, the refinancing rate is the weighted average cost of capital, the desired profitability of the project, peer assessment, interest on deposits etc. discount rate is chosen by the person who performs the calculations to determine present value.

6

The coefficient of discount is always less than 1. It determines a quantitative value of one currency unit in the future, subject to the conditions of the calculation.

Note

It is important to determine the discount rate, so that subsequent calculations were the most accurate.